Climate finance opportunities with the International Finance Corporation

The Canadian Trade Commissioner Service has more than 160 offices around the world with dedicated officers available to assist you with international trade activities. Specialized assistance is available for climate finance.

For information on the IDB, contact faheem.noorali@international.gc.ca

International Finance Corporation (Washington D.C.)

The International Finance Corporation (IFC) is the private sector arm of the World Bank Group (WBG) and is the largest global development institution focused exclusively on the private sector in developing countries. Established in 1956, the IFC currently has 184 member countries, including Canada. The IFC supports the WBG's goals of reducing poverty, increasing shared prosperity and promoting sustainable development. Since inception, the IFC has leveraged US$2.6 billion in capital to deliver more than US$256 billion in financing for businesses in developing countries. With a global presence in more than 100 countries, a network of nearly 1,000 financial institutions and more than 2,000 private sector clients, the IFC facilitates and supports business opportunities and creates markets in developing countries through three business areas: investment services (loans, equity, trade finance, structured finance, blended finance, syndications); advisory services (advice, problem solving and training); and asset management (mobilizing and managing third-party capital funds and investing in private equity funds for developing markets). In 2017, the IFC delivered a record US$19.3 billion in financing to private companies in 75 countries.

Text description

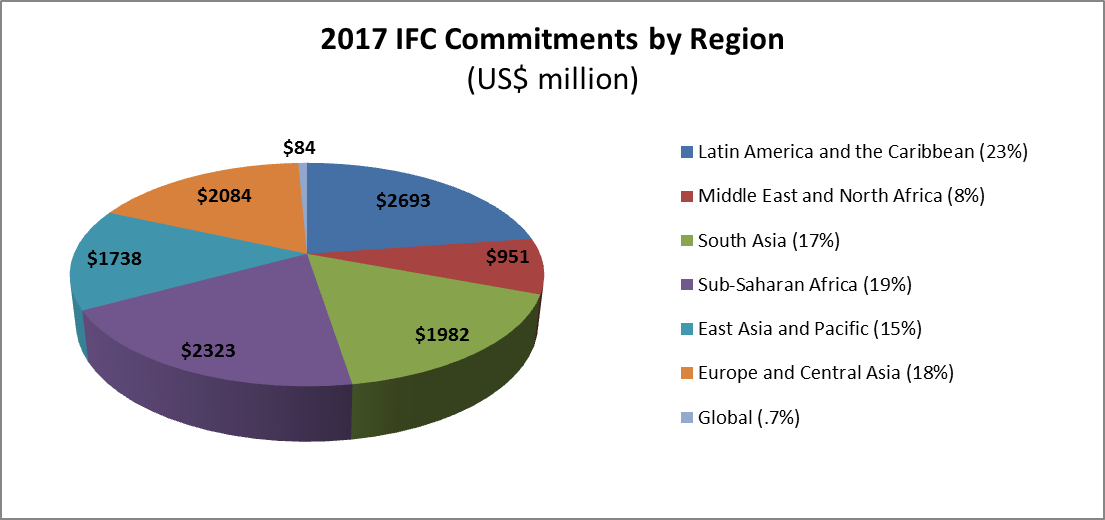

2017 IFC committments by region

(US$ million)

- Latin America and the Caribbean (23%)

- Sub-Saharan Africa (19%)

- Europe and Central Asia (18%)

- South Asia (17%)

- East Asia and the Pacific (15%)

- Middle East and North Africa (8%)

- Global (.7%)

Text description

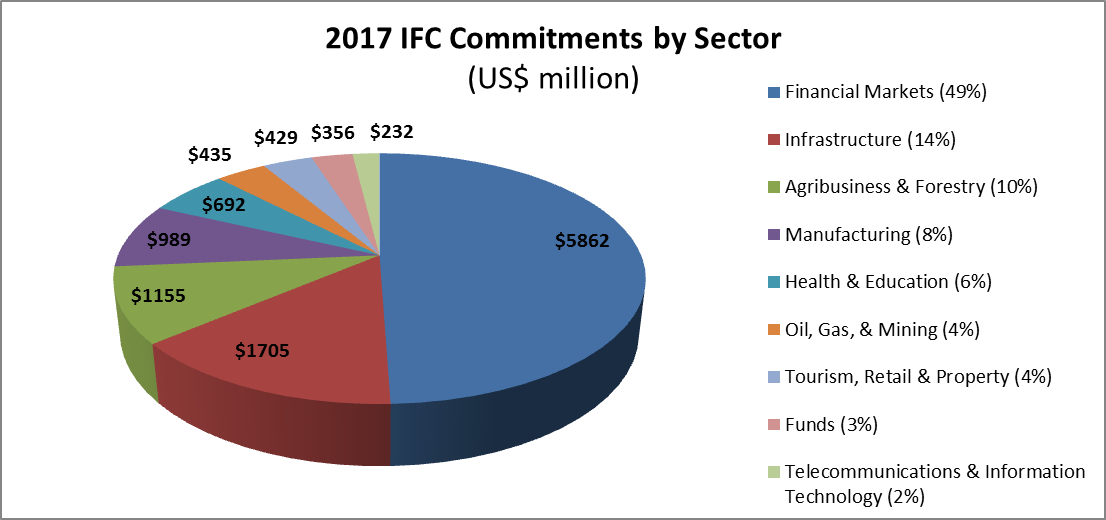

2017 IFC committments by sector

(US$ million)

- Financial Markets (49%)

- Infrastructure (14%)

- Agribusiness and Forestry (10%)

- Manufacturing (8%)

- Health and Education (6%)

- Oil, Gas, and Mining (4%)

- Tourism, Retail, and Property (4%)

- Funds (3%)

Source: International Finance Corporation (IFC)

Procurement processes

Client procurement: The IFC, as part of the World Bank Group, is generally governed by the WBG's Procurement Framework and policies and procedures, especially related to public sector clients. For private sector clients, commercial procurement practices consistent with core procurement principles (i.e. value for money, economy, integrity, fit for purpose, efficiency, transparency and fairness) apply and the IFC encourages open competitive bidding for use of IFC funding.

Corporate procurement: The IFC follows the World Bank's Corporate Procurement Policy. The World Banks's corporate procurement team is responsible for the coordination and oversight of the sourcing strategy, selection and contract execution for goods, services, construction and consulting services for the WB. Information about the World Bank's corporate procurement contract awards is available on its Corporate Procurement Contract Awards site. Vendors must complete a Vendor Registry Form to be eligible for a corporate procurement contract award.

Consulting firms and individual consultants: Individual consultants and consulting firms must register via the World Bank's eConsultant2 portal.

Private sector operations

As the private sector arm of the WBG, the IFC offers development impact solutions through firm-level interventions, direct investments and advisory services, and via the IFC Asset Management Company. In 2017, the IFC adopted the IFC "3.0" strategy, under which the IFC will expand its mobilization role and redefine development finance by creating more platforms for funding and broadening its pool of co-investors. In 2017, the IFC's investment portfolio grew to US$55 billion and focused on mobilizing additional sources of funding from other investors. To crowd-in private sector investments, the IFC manages a variety of de-risking tools and facilities including the Creating Markets Advisory Window; IDA18 Private Sector Window; Risk Mitigation Facility; Blended Finance Facility; Local Currency Facility; and MIGA Guarantee Facility. The IFC also introduced the Managed Co-Lending Portfolio Program syndication platform that creates diversified portfolios of emerging market private sector loans, raising US$7 billion from eight global investors as of 2018.

IFC 1.0

- Advances role of private sector as an economic agent

- Developed IFC expertise in emerging markets by investing with foreign private sector investors and nascent local clients

- Attracted Foreign Direct Investment in emerging markets

- Created a syndication program to bring commercial banks to our countries of operations

- Introduced equity as an engine for financial sustainability and higher impact

IFC 2.0

- Expanded IFC global footprint

- Deepened IFC' s private sector expertise by investing in local companies and banks and with local private investors

- Used local presence as landing platform for South-South investments

- Created financial vehicles to mobilize institutional investors

- Provided Advisory Services to private clients and governments, moved from donor-driven model to business lines

- Expanded operations in FCS and IDA

- Introduced parallel loans through a Master Cooperation Agreement

- Launched AMC o mobilize institutional investors on a wholesale basis

- Used blended finance in a selective way to de-risk several sectors (e.g climate, SMEs, agribusiness)

- MCPP

IFC 3.0

New Platforms to Create Markets

- Cascade to work systematically across WBG

- De-risking Projects through Blended Finance

- Upstream support for project development

- Innovation to create markets

New tools

- Private Sector Diagnostics

- Sector Deep Dives

- Ex-Ante Impact Framework

New Instruments

- IDA Private Sector Window

- Creating Markets Advisory Window

- MCPP Infrastructure

New Organization

- Economics and PSD

- Blended Finance and Partnerships

- New business, Portfolio, Risk

- Strategy and Resource Management

Source: International Finance Corporation (IFC)

Private sector finance

The IFC's financial products help companies manage risk and broaden access to foreign and domestic capital markets. The IFC offers a wide variety of financial and non-financial products for private sector projects in developing countries, including:

Loans

- Senior and subordinated debt

- Fixed and variable loans

- Foreign and local currencies

- Syndicated loans

Guarantees

- Partial credit

- Long-maturity risk management products (securitizations)

- Trade-related payments through the Global Trade Finance Program

Equity and quasi-equity

- Direct investments into entities, including venture capital, and private equity funds

- Maximum participation of 20%

Technical assistance/grants

- Advisory platform across sectors; help companies enter new markets, improve performance and sustainability, and increase impact; and assistance to governments through PPPs

For private sector financing consideration, companies should submit an investment proposal outlining: (i) the project's sponsorship/management structure; (ii) market and sales figures; (iii) technical feasibility; (iv) investment requirements, project financing, and expected returns; (v) information on government support and regulations; and (vi) timeline for project preparation and completion. For consideration, projects must be located in an IFC-member developing country, be private-sector led, benefit the local economy, and satisfy both the IFC and host country's environmental and social standards. After submitting an investment proposal, the IFC may proceed by requesting a detailed feasibility study or business plan to determine whether or not to appraise the project.

Climate finance

IFC has pledged to scale climate investments to a target of 28% of annual commitments from its own account and mobilize an additional US$13 billion of financing from the private sector by 2020. Climate finance at the IFC primarily takes the form of loan and equity investments; the IFC also makes capital available for climate-related investments via financial intermediaries, including commercial banks and private equity funds. In addition to directing its own capital toward low-carbon and climate-resilience support for private sector projects in developing countries, the IFC acts as an intermediary for the Green Climate Fund, the Global Environment Facility and the Climate Investment Funds as these funds generally do not accept direct applications from the private sector. In addition, the IFC manages other climate-relevant donor trust funds, including the IFC–Canada Climate Change Program and the recently launched Canada-IFC Renewable Energy Program for Africa. While financial products that the IFC provides from its own capital are subject to market-based terms and conditions, financial products offered through intermediated and donor funds may be offered at concessional (or sub-market) terms and conditions, at just a level of concessionality needed to facilitate the investment; thus, funding recipients are provided with a blended financing solution.

Accessing private sector and climate finance

Canadian companies can access private sector financing for climate change projects for which they are a sponsor by submitting a proposal to the IFC's industry departments; regional departments at IFC headquarters in Washington; or the regional field office closest to the location of the proposed project.