Canadian craft beer: Step-by-step guide for exporting

Disclaimer: This information is to be considered solely as a guide and should not be quoted as, or considered to be, a legal authority. It may become obsolete in whole or in part at any time without notice. Readers should take note that the Government of Canada does not guarantee the accuracy of any of the information contained in this report, nor does it endorse the organizations listed herein.

On this page

- Introduction

- Canadian craft beer industry

- Preparing for export

- Canada Revenue Agency: business number and export account

- Canadian Food Inspection Agency: Safe Food for Canadians Regulations licensing

- Other certifications (optional)

- Harmonized System codes for beer

- Pricing your products

- Understanding Incoterms®2020

- International shipping pallets

- Required export documents

- Additional shipping documents

- Checklist for craft beer export

- Building capacity

- Marketing your products

- E-commerce platforms

- Market entry strategies

- Opportunities in Asia Pacific

- Opportunities in Europe

- Opportunities in the United States of America

- Key contacts

- Annex 1

- Annex 2

- Annex 3

- Annex 4a

- Annex 4b

- Annex 5

- Annex 6

Introduction

There are now over 1,100 breweries in Canada. As the craft brewing industry in Canada has grown, so has the global recognition of Canadian beer. Canada has a reputation for some of the best barley in the world, clean air and fresh water, friendly business environment and political stability. There has never been a better time to export your beer.

In addition, Canada is the only G7 nation with free trade access to the Americas, Europe and the Asia-Pacific region because of the following trade agreements:

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

- Canada-United States-Mexico Agreement (CUSMA)

- Canada-European Union Comprehensive Economic and Trade Agreement (CETA)

- Canada-Korea Free Trade Agreement (CKFTA)

For many businesses, exporting can be daunting. To determine your export readiness and potential be sure to check out the Trade Commissioner Service resources. This guide will also help to make the export process less complicated by providing export-ready breweries with practical information on:

- export requirements

- preparing for export

- market entry strategies

- specific export markets that present the best opportunities.

A variety of resources available to assist with export is provided in this guide. With constantly changing regulations, be sure to use these resources for the most up-to-date information. Moreover, your first stop should be the Trade Commissioner Service Regional Office network in Canada.

Cheers!

Canadian craft beer industry

As of January 2021, there are over 1,100 breweries spread across every province and territory of Canada. About half of these breweries are less than five years old.

This new brewing capacity has positively positioned Canadian craft breweries for export markets which have to date largely been ignored by breweries focused on local growth. As local markets move closer to saturation, Canada's craft breweries are seeking growth in international export markets.

Thankfully, Canada produces some of the finest raw ingredients used in beer. Canada also has internationally respected graduates from brewing programs at Niagara College, Olds College and Kwantlen Polytechnic University. Indeed, Canada is even at the forefront of craft beer packaging. Calgary's Cask Global Canning Solutions invented the ubiquitous inline craft beer canning line in Canada.

Canadian barley is a coveted beer ingredient around the world. Sixty-five percent of malted barley grown in Canada is exported abroad. This represents $268 million and accounting for nearly 10% of global malt exports. The three most common barley varieties used in beer in North America were bred in Canada. They are CDC Copeland, AAC Synergy and AC Metcalfe. New barley varieties specifically bred for craft brewers are emerging from Canada's public breeding programs, including CDC Bow, AAC Connect and CDC Fraser. This is thanks to the work of a network of organizations including:

- Agriculture Agri-Food Canada

- the Crop Development Centre at the University of Saskatchewan

- the Canadian Barley Research Coalition

- the Canadian Malting Barley Technical Centre

- the Brewing and Malting Barley Research Institute

New, small craft maltsters are now even improving upon the global reputation of Canadian malted barley.

Canada is also now breeding new varieties of hops. While hops from Manitoba are the pedigree of many old varieties, Lumberjack and Sasquatch, are the first hops bred and patented in Canada. At the same time, hops farmers are also rediscovering old Canadian varieties such as Wild Türkiye.

Canadian breweries are now gaining an international reputation for the quality of their beer and their innovation. They are armed with the best ingredients, the best people and the best packaging. They are winning medals at some of the world's largest competitions for beers in classic styles. They are also creating new flavour combination sought by beer lovers from around the world.

All of these elements help to elevate Canada's craft beer reputation globally.

Preparing for export

Canada Revenue Agency: business number and export account

The first step in preparing for export is to register for an import-export program account with CRA. Your business is required to have a CRA-registered export number for export purposes. This number, referred to as the RM number, is used to process customs documents. To avoid delays in releasing your goods at the border you must open your program account before you plan to export goods.

The CRA does not list the export account in the My Business Account web application, so it will not appear when logged in - only the Corporate Income Tax & GST business accounts will appear. Check with your accounting department if you are unsure if your business has an RM number.

For exports, CRA's scope is limited to managing the registration of the export business. The company should register for an export number if it has not already done so.

The RM number is usually 0001. If your company has more than one import-export number attached to your business number, your export number may come up as RM0001 or RM0002, etc. (Example: BN 123456789 RM0001).

When applying for an RM number, the business number must match the address under which your company registered the business. Some companies have several locations, so it is important to use the business number that matches the registration.

When you register for a business number, include all your business's names that may appear on customs release forms and documents, such as invoices. If the name on the customs release document is different from the name CRA has on file, your goods may be held up at the border.

To register for an import-export program account (RM), go to How to register for a business number or Canada Revenue Agency program accounts.

Canadian Food Inspection Agency: Safe Food for Canadians Regulations licensing

Registration with the Canadian Food Inspection Agency (CFIA) and acquiring a license under the Safe Food for Canadians Regulations (SFCR) is the second step in preparing for export.

A SFCR License/MyCFIA account is required for exporters of alcoholic beverages if an export certificate is required from CFIA (Certificate of Free Sale). If the importing country requires a certificate of free sale (COFS), your business must apply for an SFCR License.

The CFIA issues SFCR licenses and export permissions in the form of a COFS. The COFS is an important document required for exporting and must be issued before the product leaves Canada.

Registering a My CFIA account online

Everyone who will be using My CFIA must create a Contact Profile. A Contact Profile identifies each user in the system and allows others share access to their Party Profile.

To request services on behalf of a business, you must proceed with the following:

- go to the sign in page

- choose a secure sign-in method (sign-in partner or GCKey)

- It is advised to use the GCKey option. Registration of GCKey takes a minute to set up, but the process is straightforward. Using GCKey, you will not have to pull out your bankcard when you need to sign in.

- create a contact profile by providing your name and company email

Once you have completed these steps, you will be ready to start using My CFIA for personal use. Next, you must register for business use.

Signing up for business use

Once you have created a Contact Profile, create a Party Profile that you can use to request services on behalf of your business. Before you sign up to use My CFIA for your business, you need to have some information and documentation available. You will also need to make some decisions about how you want to set up your profile.

You will need the following documents on hand to make a quick and easy application:

- Business Number

- Legal Business Name

- Supporting Documents:

- Proof of Authority Form (PDF format) (filled out and scanned in as a document on your computer, ready for uploading to the application)

- Proof of Business document (certificate of incorporation, or business registration, or T2 Corporation Income Tax Return)

- Office addresses

- where records of regulated activities are kept

- billing addresses

- physical addresses

- Preventive Controls Plan (PCP) and Traceability Plan. You may already have one for your provincial license as a manufacturer. This is just a matter of having the document on hand on your computer to uploading with the application. If you do not have a written PCP, you will need to create one before you can request an SFC License. You can still sign up for a My CFIA account, but you will have to wait to request the SFC license until you have a written PCP in place.

Once you have the required documents, please go to the My CFIA site and sign up for your account. Instructions are straightforward; just follow the prompts.

Please see "Annex 1: Background and prep for a My CFIA Party Profile and SFCR License Request" for further information on how to create your Party Profile.

Preventive control plan

CFIA requires every food manufacturing facility to have a written Preventive Control Plan (PCP) for their operations.

A PCP is a written document that demonstrates how hazards to your food are identified and prevented, or eliminated or reduced to an acceptable level.

The PCP is based on the internationally accepted principles of the Codex Alimentarius General Principles of Food Hygiene. It includes elements relating to packaging, labeling, grading, and standards of identity and food safety.

The following table shows the areas that pertain to manufacturers and exporters of Canadian beer. Click on the links below to see a detailed explanation of requirements for each section of your PCP.

| Activities | Sections of this document that apply to you | Corresponding provisions from the SFCR |

|---|---|---|

| You have a license to manufacture, process, treat, preserve, grade, package or label food for export and would like to obtain an export certificate or other export permission from the CFIA |

|

Full details on PCP can be found on CFIA's regulatory requirements page.

To help breweries understand what a completed PCP looks like for the brewing industry, please see Annex 2: Sample Preventive Control Plan for Breweries.

Traceability plans

To meet the requirements in the Safe Food for Canadians Regulations, each manufacturer must have a traceability plan. The requirements are based on the international standard established by Codex Alimentarius – tracking food one step forward to the immediate customer and one step back to the immediate supplier – and help facilitate recalls and consumer protection.

Manufacturers must identify the source of each ingredient that goes into the production of their beer and must prepare, keep, and retain traceability documents for each product produced. Manufacturers must also keep a record of buyers to which the products are sold, traceable through their lot codes.

For more information on how to complete a traceability plan for your facility, please visit CFIA's traceability for food page.

Traceability plan for exporters

If the manufacturer is using a third party (Exporter – not involved in the manufacture of the goods) to export their products, the exporter will need to use a simplified traceability plan.

- Identify the food

- Common name of food: Beer

Name and address of company who manufactured, stored, packaged, labeled the food.

Name of Brewery and each product ordered is recorded on Product Order Sheet.

- Unique Identifier: Lot Code from each product is recorded on Product Order Sheet.

- One step back:

- Name of food manufacturer: Name of Brewery recorded on Product Order Sheet.

- Date delivered: date recorded on Product Order Sheet.

- One step forward:

- Name of the organization to which the food was sold: Buyer is recorded on Product Order Sheet.

- Shipper information: Shipper recorded on Product Order Sheet.

- Date delivered to buyer: Handoff to shipper date recorded and ETA date recorded on Product Order Sheet.

Other certifications (optional)

Hazard Analysis and Critical Control Points

Hazard Analysis and Critical Control Points (HACCP) certification is an internationally recognized system that indicates a business has gone through the necessary 3rdparty audit and has developed principles and procedures to ensure that all food safety risks are covered.

A HACCP based system is a legal requirement for food manufacturers in several countries and regarded favourably when entering new markets around the world. This certification is optional but recommended.

For more information on how to apply for HACCP certification in Canada, please visit the Beer Canada website.

British Retail Consortium

The British Retail Consortium (BRC), founded in 1996, publishes standards that describe quality, safety, and operational criteria for manufacturers in order to attain BRC certification for food safety standards. These harmonized food safety standards are recognized globally and used by suppliers in over 130 countries around the world.

BRC certification is optional but considered one of the leading global food safety certification standards.

Harmonized System codes for beer

Harmonized System (HS) Codes are a standardized method for classifying products for import and export. The harmonized system is used by customs authorities to identify products when assessing duties (tariffs), taxes and other fees.

You will need an HS code for your products for the following:

- Export Declaration

- Shipping documentation such as commercial invoice, certificate of origin

- To determine import tariff rates in the country you are shipping to and determine if your product qualifies for a preferential tariff under a free trade agreement

- To conduct market research and obtain trade statistics

Canada uses an eight-digit HS export number to classify products for export. There are two headings to consider when using HS codes for beer: non-alcoholic beverages and alcoholic beverages.

Non-alcoholic beverages are considered to have an alcoholic strength by volume not exceeding 0.5% vol. and are classified under heading 22.02. The eight-digit HS code for non-alcoholic beer is 2202.91.00.

Beer made from malt is classified under heading 22.03. The eight-digit HS code for beer made from malt is 2203.00.00 for beer made from malt.

For more information on Canadian Export Classifications, please visit Statistics Canada's export classifications of beverages, spirits and vinegar.

To find tariff information on countries you are exporting to, please refer to the Tariff Finder.

Pricing your products

Pricing your products for export requires a solid knowledge of the true cost of materials and labour that go into manufacturing your product. Compared to selling your product in Canada, there are far less expenses that need to be accounted for when setting a sale price. This process is important because the additional logistics, export and import costs will substantially increase the cost of your beer in the foreign market.

The following are costs that can be omitted when determining the price of your product:

- Federal Excise Duty

- GST, PST and/or HST

- Deposits & Recycling Fees

- Provincial Markups

- Expenses related to storage

In most cases, shipments will be picked up from the brewery, so any fees from any provincial warehouses (receiving, stocking, etc.) will not apply.

The following costs will have varying impact on your pricing depending on the incoterms used as well as the relationship with the importer and/or exporter you are working with:

- Expenses related to shipping (certain incoterms will require you to pay for part of the shipping)

- Sales & Marketing expenses (if importer/exporter is taking on some or all of these tasks)

A general rule of thumb is to determine the cost of making your product by considering the costs of:

- raw materials

- direct utilities

- time spent in fermenters and/or aging tanks and/or bright beer tanks

- packaging materials

Next, it is essential to mark the product up in accordance with your profit margin goals. When marking the product up and setting your sale price, it is useful to engage importers and other key contacts to gauge the competitive landscape and remain competitive.

Understanding Incoterms®2020

International Commercial Terms (Incoterms®) are legal commercial terms used to determine the responsibilities of the buyer and the seller during the shipping process. Incoterms®are developed and regulated by the International Chamber of Commerce for international trade and are designed to define the point at which the responsibility and ownership for the shipment transfers from the seller to the buyer and to determine which costs are covered by the seller and which costs are covered by the buyer. Costs include:

- transportation fees

- import and export processes

- insurance

- loading and unloading of the product

If you choose the wrong incoterms, you may be surprised with additional costs you had not intended to bear.

There are eleven incoterms, divided into two main categories:

- Terms for use with any mode or modes of transport: EXW, FCA, CPT, CIP, DPU, DAP, DDP

- Terms for use with sea and inland waterway transport: FAS, FOB, CFR, CIF

The terms most favourable for exporters are EXW, FCA, FAS, and FOB as the buyer pays for the shipping costs.

The following definitions of the most favourable terms are from Incoterms®2010, published by the International Chamber of Commerce.

EXW – Ex Works

"Ex Works" means that the seller delivers when it places the goods at the disposal of the buyer at the seller's premises or at another named place (i.e., works factory, warehouse, etc.). The seller does not need to load the goods on any collecting vehicle, nor does it need to clear the goods for export, where such clearance is applicable.

FCA – Free Carrier

"Free Carrier" means that the seller delivers the goods to the carrier or another person nominated by the buyer at the seller's premises or another named place. The parties are well advised to specify as clearly as possible the point within the named place of delivery, as the risk passes to the buyer at that point.

FAS – Free Alongside Ship

"Free Alongside Ship" means that the seller delivers when the goods are placed alongside the vessel (e.g., on a quay or a barge) nominated by the buyer at the named port of shipment. The risk of loss of or damage to the goods passes when the goods are alongside the ship, and the buyer bears all costs from that moment onwards.

FOB – Free On Board

"Free On Board" means that the seller delivers the goods on board the vessel nominated by the buyer at the named port of shipment or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel, and the buyer bears all costs from that moment onwards.

Useful resources

- Receive a free Introduction to Incoterms®2020

- Download a free wall chart of Incoterms®2020

- Get the free app for Incoterms®2020

The Incoterms® Rules are protected by copyright owned by ICC. Further information on the Incoterm ®

Rules may be obtained from the ICC website

Incoterms®and the Incoterms®2020 logo are trademarks of ICC. Use of these trademarks does not imply association with, approval of or sponsorship by ICC unless specifically stated above.

International shipping pallets

Proper international shipping pallets must be used for all palletized shipments leaving Canada. There are different types of pallet materials ranging from plastic to wood, with wood pallets being the most economical. The use of improper pallets may result in import delays or refusal of entry to the country of import.

Wooden shipping pallets must comply with phyto-sanitary standards and bare the internationally recognized mark.

The IPPC mark/ISPM 15 is required on at least two opposite sides of each pallet used for shipping internationally as this certifies that all solid wood has met heat treatment (HT) requirements.

Sample IPPC/ISPM 15 mark:

The International standard pallet size is 48" x 40" however, you should confirm with your importer for any special requirements.

| Pallet Dimensions (inches) | Pallet Dimensions (millimeters) | Most used in the following Region(s) |

|---|---|---|

| 48.00 x 40.00 | 1,219 x 1,016 | North America |

| 44.88 x 44.88 | 1,140 x 1,140 | Australia |

| 43.30 x 43.30 | 1,100 x 1,100 | Asia |

| 42.00 x 42.00 | 1,067 x 1,067 | North America, Europe, Asia |

| 39.37 x 47.24 | 1,000 x 1,200 | Europe, Asia |

| 31.50 x 47.24 | 800 x 600 | Europe (fits tight spaces and many doorways |

Pallets can be new or recycled and sourced through Uline, CHEP, Pallet King, or other local suppliers.

Examples of pricing for new, recycled and block pallets can be found on the following Uline pages:

Required export documents

Certificate of free sale

Check with your importer to determine if a COFS is required for the country to which you are exporting. If so, proceed with the following steps to apply for an export application online:

- go online to your My CFIA account

- click on your Party Profile

- scroll to the bottom and click New Service Request

The instructions are straightforward; just follow the prompts for each section.

Lot Code box

The lot code refers to a code that used to identify a lot that was manufactured, prepared, produced, stored, graded, packaged, or labelled, under the same conditions. A lot code can be numeric, alphabetic, or alphanumeric. (Examples are production date, best before date, batch number). The Lot Code must match what is marked on the can/bottle label (usually on bottom of the can or wherever you lot mark your product) in order for it to pass inspection at the destination country. Whatever you stamp on the cans/bottles must be entered in the Lot Code box.

See the CFIA website for a step-by-step guide on how to fill out your application for Certificate of Free Sale and Application for Certificate of Free Sale form (PDF format).

Export declaration

An export declaration is a customs form that must be submitted when exporting commercial goods from Canada. Reporting can be filled through an automated service when exporting to countries other than the United States (U.S.), Puerto Rico, or the U.S. Virgin Islands.

Useful resources:

- In order to create export declarations you will need to use the CERS application.

- For information on the Canadian Export Reporting System, please contact CBSA.CERS_Inquiries-Renseignements_SCDE.ASFC@cbsa-asfc.gc.ca.

- Application form for CERS

You are required to report all exports to the Canada Border Services Agency (CBSA) according to the following schedule:

- Air: 2 hours before the goods are loaded onto the aircraft

- Marine: 48 hours before the goods are loaded onto the vessel

- Rail: 2 hours before the goods are loaded onto the railcar

- Road: Immediately before leaving the country

You can also request your shipper to fill out the export declaration on your behalf.

Certificate of origin

A certificate of origin (CO) is an international trade document completed by exporters to declare the origin of their products. When exporting internationally you must include a certificate of origin with your shipment.

The importer uses this document at customs to justify the products eligibility for entry into the country and any preferential tariff treatment that may apply.

Where a free trade agreement (FTA) is in force between Canada and the country you are exporting to, you should use a preferential CO.

There is no global standard form for certificates of origin, so the required information and format will vary according to the rules of the free trade agreement. For Canada's three major agreements, the basics of creating a certificate of origin or equivalent are as follows:

- NAFTA/CUSMA: With the introduction of the Canada-United States-Mexico Agreement (CUSMA), a certificate of free sale is required to claim preferential tariff treatment. Visit the CBSA website for more comprehensive information on what is required to certify the origin of goods

- Canada-EU Comprehensive Economic and Trade Agreement (CETA): The CETA rules do not require a formal certificate in order to obtain tariff benefits. A declaration on the invoice or any other commercial document accompanying the shipment is enough. The declaration has a specific wording, which is available in Annex 2 – Text of the origin Declaration.

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): This is a multilateral FTA between Canada and 10 other nations. There is no standard certificate template, but the minimum data requirements are the same for all CPTPP members. You can find them in Annex 3-B of the agreement. You can add the declaration to any document accompanying the shipment, or on a separate document. The declaration must include the statement given in part 9 of Annex 3-B.

To find certificate forms for Canada's other free trade agreements, go to the Forms section of the CBSA website and type "certificate of origin" into the Filter Items box. Also, visit Export Development Canada's website for more information on understanding certificates of origin.

If an FTA is not in force between Canada and the country to which you are exporting, a non-preferential certificate of origin can be obtained from the Canadian Chamber of Commerce (CCC) for a fee. The CCC is accredited by the International Chamber of Commerce as an issuing body for providing these certificates in Canada. Even if there are no preferential tariff treatments, the document is used by customs authorities to determine tariff amounts and for statistical purposes.

- Free Trade Agreement - Certificate of Origin Form (PDF format)

- North American Free Trade Agreement – Certificate of Origin Form (PDF format)

Additional shipping documents

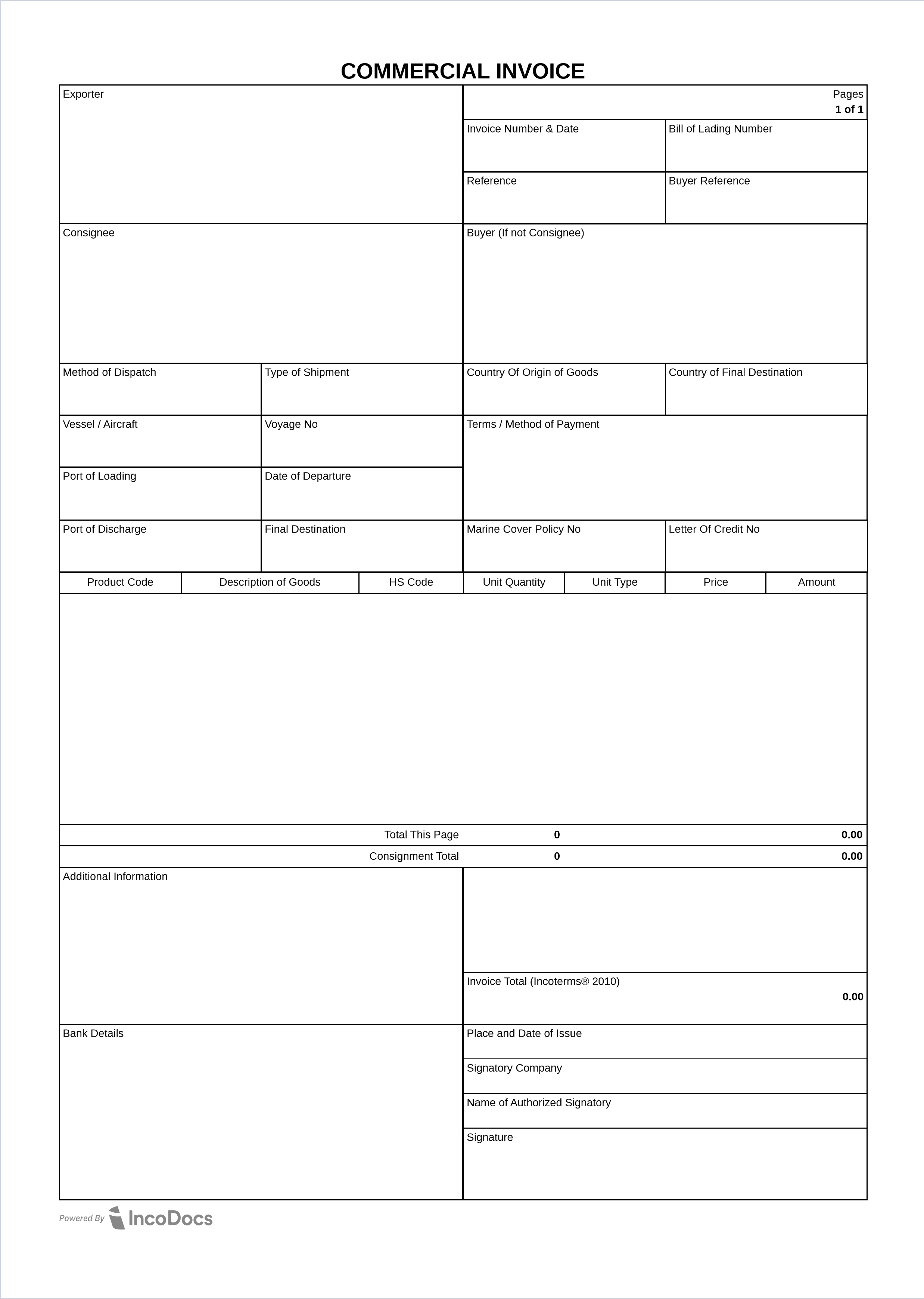

Proforma or commercial invoice

Proforma and commercial invoices are important documents used in global trade. Once your buyer has issued a purchase order, you can issue a proforma invoice. The proforma invoice confirms the details of the order and can include your bank details for requesting payment.

The commercial invoice is issued once the goods have been shipped and confirms the exact quantity of products that have been loaded and shipped. Due to manufacturing issues, supply issues, etc., the quantity on the proforma can differ from the actual commercial invoice.

The commercial invoice is used by the buyer, freight forwarder, and Customs authorities to clear the goods into the country of import and determine the value of goods for appropriate tariffs/taxes applied.

Do not include extra items in your shipment of beer. Some free t-shirts, coasters, stickers or marketing materials not included in your export documents could delay clearance of your perishable beer for weeks.

See Annex 3 for a commercial invoice specimen.

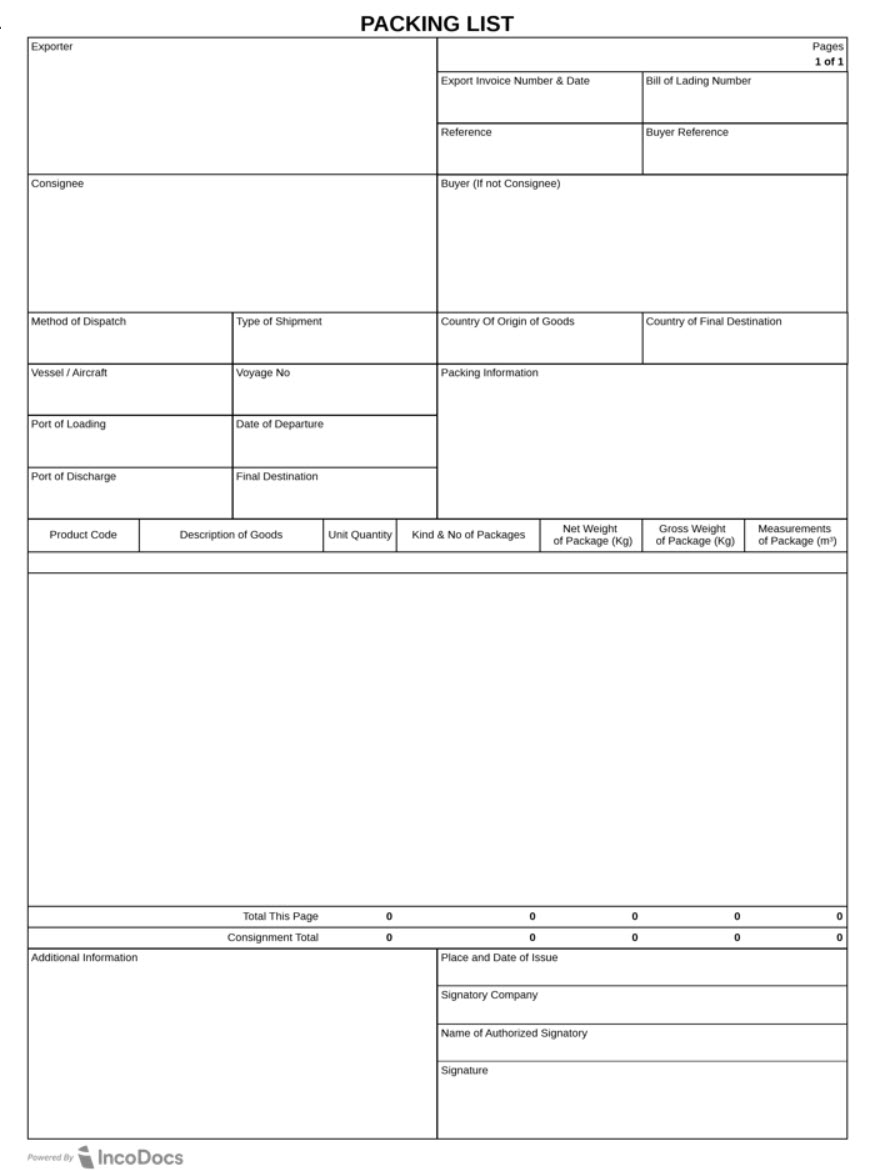

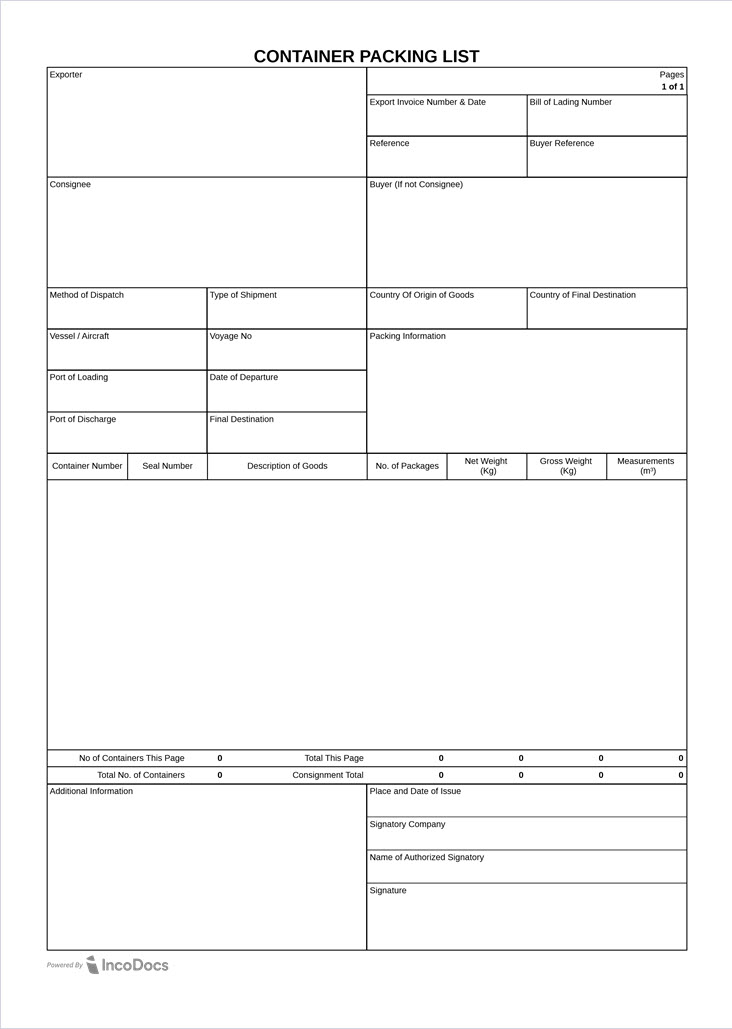

Packing list

A packing list details what is shipped from the seller to the buyer and used by your freight forwarder to generate a bill of lading for your shipment. Customs officials use the packing list to verify goods and clear for entry into the destination country.

The packing list identifies all items in your shipment and includes the net and gross weights and dimensions of packages as well as markings that appear on the packages.

You can use your packing list to double-check against your purchase order from the buyer to ensure you are sending the correct items. Items listed on packing list must match all items on your commercial invoice.

There are different types of packing lists and depending on your shipment; you may choose to use a packing list for full container shipments (FCL) or a detailed packing list for less than container load (LCL) shipments. The detailed packing list will show what is on each pallet when shipping mixed pallets.

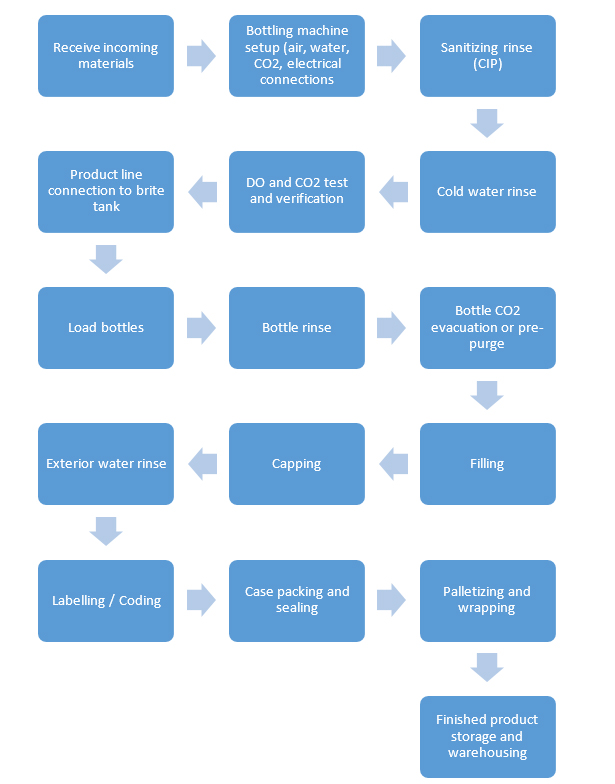

See Annex 4 for packing list specimens

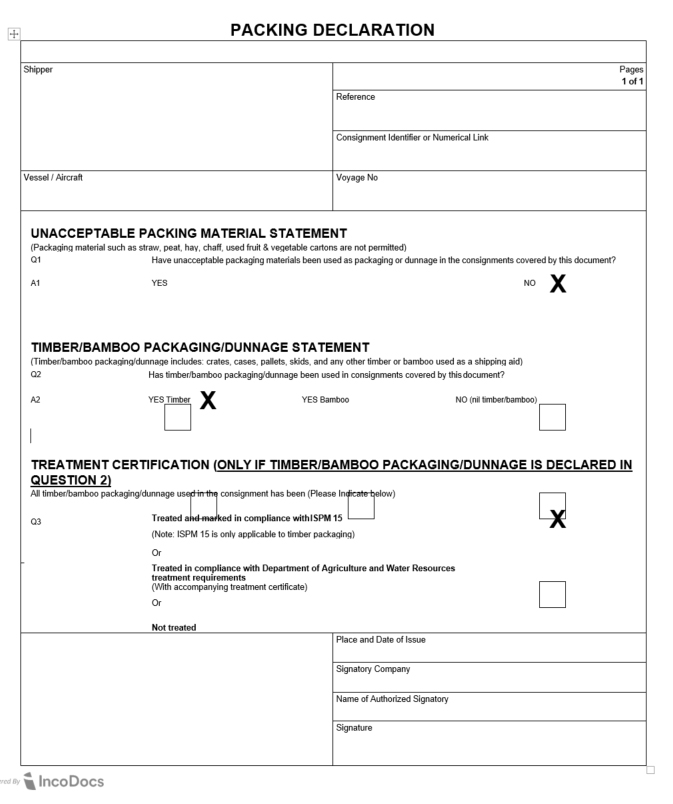

Packing declaration

A packing declaration describes the type of packing materials used to pack your products in the container. All timber packaging, including wooden pallets and dunnage, must be ISPM15 compliant to protect against the spread of insects and disease. Your packing declaration is a statement on company letterhead that details the type of packing materials used in your shipment and that all timber meets ISPM15 requirements. Pallets will bear the heat-treated ISPM15 stamp and the signed document ensures that your shipment will not be pulled for quarantine and treatment before clearing customs at the country of destination.

See Annex 5 for a packing declaration specimen

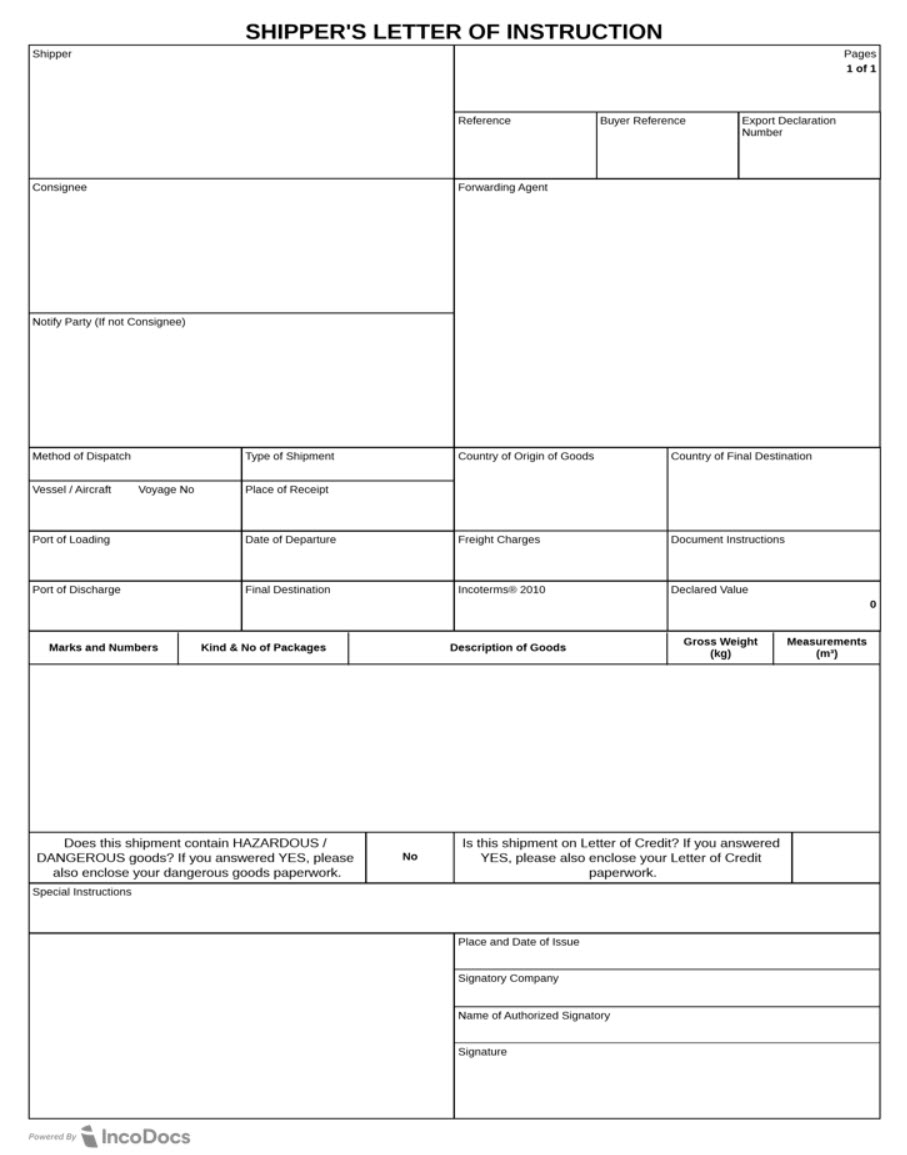

Shipper's letter of instruction

A shipper's letter of instruction (SLI) is a contract between the shipper (you) and the freight company organizing the transport of your shipment. This document provides information required for your freight forwarder to handle the export of your goods and provides ports, customs, and shipping lines involved in the transaction with all relevant information.

See Annex 6 for a shipper's letter of instruction specimen

Checklist for craft beer export

This checklist provides as an overview of the steps and considerations for exporting craft beer from Canada.

General requirements

- I have an RM number from CRA

- I have a My CFIA account and an SFCR License from CFIA

- My product has been manufactured or prepared in accordance with Canadian regulations (including labelling)

- I have documented preventative food safety controls in place

- I am aware of the fees for certification, inspection and sampling for my product through cost recovery

- I have traceability procedures for my product including any suppliers and buyers one step forward and one step back

- I have all the following documents required for the export of my beer:

- Certificate of Free Sale

- B13a Export Declaration Form

- Certificate of Origin

Foreign country requirements

I have consulted and aware of the importing country's requirements for my beer through a review of:

- CFIA Export Library

- Foreign Authority

- My Importer

- Trade Commissioner

Export certification

- I have applied for a Certificate of Free Sale from CFIA

- I meet the attestations and statements of the Certificate of Free Sale and have completed the certificate

- I have notified CFIA for any inspection or testing required in order to be eligible to export

Validation / certification

- I am aware that at any time, the foreign country I am exporting to may come and audit my establishment to be on their export list, or they may visit my establishment as part of an audit of CFIA's inspection systems

- I may be asked to take corrective actions that are above those of the Canadian regulatory requirements to maintain specific market access

Shipping craft beer for export

- I am aware of the use and control of certificates and certificate numbers

- I am aware of the use and control of stamps, stickers and seals for my beer

- I am aware of the food safety requirements for the transportation method chosen for my beer

Building capacity

When planning to export, you will need to assess the current production capacity of your brewery and plan any necessary expansion. Capacity expansion may be required for fermenter and bright beer tank capacity, but for new equipment for pasteurization, packaging and even cold storage space. It is essential to speak with your buyers and/or importers when planning any expansion to ensure that your facility can handle the volume of export production as well as meet the local requirements for packaging and shelf life specified by the buyer.

If your brewery is looking to use additional available tank capacity, export can be a helpful method to keep the capacity profitable. However, keep in mind that excess capacity is generally a temporary state in a healthy business, so it is prudent to ensure export goals are integrated into any future expansion planning.

Contract brewing and licensing

If additional capacity within your own physical brewery is not an option, you may want to consider alternative methods of production, such as contract brewing or licensed production. Both aforementioned options are effective ways to increase production volumes with minimal capital investment.

The prevalent downside to a contract or licensed production agreement is added costs and therefore lower profit margins.

The primary benefit of these production arrangements is that they typically have a drastically shorter lead-time to production as there is no delay as there would be with fabrication and commissioning of new equipment. Additionally, the immediate cash flow impact of contract brewing is lower than that of purchasing and installing new equipment. If you are looking at selling in a country which has different package sizing than Canada (i.e. 330mL vs 355mL cans) it may be advantageous to produce your beer outside of Canada and make use of the supply of the appropriate package sizes.

Contract production

Contract production is the production of a product to a brewery's specifications in a facility not owned by the brewery. Contract production allows the brewery to continue to produce the product within Canada and maintain ownership and control of the recipe but also the physical ownership of the beer. It may also be possible to contract-produce your beer overseas though it may be more complicated logistically than licensed production (for example sourcing similar ingredients overseas).

Licensed production

Licensed production differs from contract brewing as it is generally produced at a facility within the buying party's country. An example of this would be an Ontario-based brewery who licenses the production of their stout recipe and all related branding to a manufacturer in Australia.

Grants and other resources

If your brewery decides to add physical capacity to your existing facilities, you may be eligible for government grants that cover some of the costs associated with such activities. AgPal is a fantastic resource for research into grants for which your brewery may be eligible. Additionally, the Canadian Agriculture Partnership website has links to provincial contacts for agri-food grants for which breweries may qualify. You can also inquire with your local craft brewers association for other local grants that may be available.

In summary, there are three main ways to increase your capacity, each with their own benefits and downsides. The most essential partnership in understanding which method is best for your situation is the partnership with your exporter or buyer. Understanding the needs and timelines of the buyer will help you choose the most appropriate method, long-term or short-term of increasing your capacity.

Marketing your products

The first step to successful marketing is to pick the right product to market. If you have a beer made with ingredients associated with Canada (iceberg water, maple syrup, etc.), these will be great to market abroad. Acknowledging that this is not possible for all breweries, how do you market your standard lineup of beers abroad?

If your marketing is well received in Canada, it is not necessarily the case that changes are required for foreign markets. Having said that, it is obviously best to tailor marketing to your new audience.

The first step is to understand any legal restrictions in the export market. Certain countries have an outright ban on the advertising of alcohol. Other countries have mandatory disclaimers and disclosures on alcohol advertising (health warnings or responsible consumption statements). In addition, the export country may have an alcohol advertising code. Your import partner will help you with these.

Of course, marketing of your beer is not restricted to advertising. Your label art and packaging is itself marketing and if you are preparing labels for export markets (to comply with export labelling requirements), this is a great opportunity to tailor your beer label and packaging to the foreign market.

Whether your marketing will be stand alone advertising materials or restricted to your labels, the following factors should be considered.

The entire premise of this export guide is that Canada has a great global reputation. Your marketing materials should take advantage of that. Canadian nature imagery should be utilized, as well as the maple leaf, a globally recognized symbol of Canada. In addition, as Canada is perceived as an agricultural country, any grain to glass aspects of your beer should be promoted.

Certain countries have a specific affinity for certain aspects of Canadiana. The Canadian Rockies are popular with Asian and German tourists. Polar bears and other Canadian animals are adored in specific countries. Even "Anne of Green Gables" imagery is popular in certain countries. Work with your importer to take advantage of this.

In our experience, foreign markets rely heavily on public beer ratings (for example, Untappd) in choosing unknown beers. To the extent that your beers and brewery have good ratings, these should be emphasized in marketing materials. Similarly, let consumers know about any awards your beers have won. Keeping in mind that your beer is likely to be relatively expensive in the foreign market, anything that can demonstrate that your beer is worth the extra money is a great way to overcome buyer resistance.

For printed material, while it is not always necessary to have the material translated, if you choose to do so, work with a good and reputable translator. Good translators do not just translate words. They can translate tone and protect you from using awkward phrases that have different connotations in foreign languages.

Leave your beer names in English. This will help drinkers find your beers on public rating websites and names rarely translate into other languages well. If your beer name is a pun, that pun will almost never translate, so just leave the name in English.

The Government of Canada often organizes or sponsors "Taste of Canada" events in foreign countries. These can take the form of trade events or pop-up online shops promoting Canadian food products. Similarly, work with your importer to see if there are any opportunities to participate in local beer festivals. Around the world, craft beer is a community and nothing will sell your beer as well as your own people telling the story of your beer and brewery.

Collaboration brews are also a great way to get out your brewery's name. By partnering with a local brewery in the export market, you bring instant credibility to your brand with the goodwill of your collaboration partner automatically lent to your brewery.

Lastly, be sure you discuss marketing with your import partner from the beginning. Some will take care of all marketing, others will expect you to provide it and others will expect you to provide a marketing budget. These matters need to be determined up front.

In addition to the monetary costs of marketing materials, these materials will likely need to be exported separately. Marketing materials are goods that are different from beer and will require different documents. Do not include a few free t-shirts (as an example) in your shipment of beer. Those extra items can have a devastating effect on your shipment if they cause delay on entry or penalties for incorrect documentation.

E-commerce platforms

Due to the Canadian regulatory environment, there are currently few opportunities to sell your beer online within Canada, other than local direct delivery. Therefore, it comes as a surprise to many Canadian breweries that e-commerce platforms selling alcohol are common in other countries and may be an appropriate way for Canadian craft breweries to enter export markets.

To take advantage of these opportunities, you should be able to answer three fundamental questions:

- will you have your own virtual storefront, or sell your beer through another online marketplace?

- will you carry inventory in the export market, or ship from inventory in Canada?

- will you fulfill orders yourself, or use the services of a fulfillment centre?

There are advantages and disadvantages to each.

By utilizing your own storefront, you can maintain control of the entire sales process, including capturing the data about your purchasers. Existing marketplaces, by contrast, will capture your sales data and often use it to their own advantage. The flipside of this disadvantage is that an existing marketplace, aside from generally having greater public awareness and trust, can utilize its sales data to direct appropriate customers to your products; significantly reducing your customer acquisition costs. In addition, existing online marketplaces are usually in the correct language and are aware of local tastes and norms. Many online shoppers in foreign countries do not trust international websites at all. Naturally, online marketplaces generally charge fees, ranging from set up and SKU fees to a portion of each sale.

Carrying inventory in the export market obviously costs money, both in terms of the inventory itself and, often, for warehouse space. There will also be management time in monitoring and managing the inventory in another country. However, by carrying inventory in the export market, shipping times and costs are significantly reduced, as is the risk of product damage. In addition, customs clearance is easier, reducing the probability of further shipping delays damaging consumer trust.

According to one study, the following barriers are experienced when inventory is not maintained in the foreign country:

- 61% of shoppers will abandon their cart if shipping, taxes and other fees are too high

- 53% of shoppers say speed of delivery is an important factor when evaluating online orders

- 25% of shoppers have cancelled an order because of slow delivery

- 38% of shoppers will never shop with a retailer again if they had a poor delivery experience

For these reasons, there are significant benefits to maintaining inventory within the foreign country.

Once an order is placed, it must be fulfilled. You can have your own staff to package and ship the order, or you can use a full-service fulfillment agent. Some online marketplaces offer fulfillment services as well as order processing. There are many significant benefits to using a fulfillment service. They typically offer effortless logistics, including having delivery and service standards, they offer unlimited storage, they can reduce the cost of shipping (particularly if they can ship other products together with your beer), they offer customer service (in the appropriate language) and they can handle returns. The downside of fulfillment services is the added cost to you; first and foremost, often, returns that are too easy as such services are motivated to keep their customers happy, even if at the vendor's expense.

Popular e-commerce platforms for beer

In Europe:

In China:

- Tmall Global (in Simplified Chinese only) (part of Alibaba)

- JD (in Simplified Chinese only)

- Epermarket

- ele.me (in Simplified Chinese only)

In Japan:

The Canadian Trade Commission Service is always ready to help. To start, review the online resources on the Trade Commissioner Service E-commerce page.

Market entry strategies

Your first order of business is to determine to which country you wish to export. As discussed elsewhere in this report, different international markets have different levels of receptiveness to import beer and to craft beer. Your ideal export target will be receptive to both, after which you can leverage Canada's reputation and your own marketing strategies to successfully market your beer. Lastly, you should consider whether you could take advantage of counter-cyclicity when choosing an export market. Typically, Canadian breweries are busiest in the summer months and by exporting to markets in the southern hemisphere, there is some ability to increase sales without additional capital expenditure by using off-season excess capacity to make beer for summer elsewhere.

Before you enter a market, be sure that your names, of both your brewery and any beers you wish to export, do not mean something untoward in the export market. Sometimes, there may be local meanings of significance that work in your favour, making one of your beers marketable based on name alone. Also, check local trademarks and if you wish to protect your own trademarks in the foreign market, work with an appropriate lawyer. The Trade Commissioner Service can provide a list of relevant lawyers.

Once you have decided on your export markets, you must decide how to enter those markets.

Direct sales

One simple way to enter a new market is the same way you entered the domestic market: by hiring a sales team and start selling. Of course, this method can be expensive, in terms of salaries and complying with foreign employment standards, but it has been done with success.

In fact, Collective Arts Brewing of Hamilton, Ontario has built sufficient demand in the United States to warrant building a second brewery, in Brooklyn, New York. Similarly, Lake of the Woods Brewing of Kenora, Ontario has built a brewery in Minnesota to support sales there. It is not just the US where Canadian breweries have achieved direct sales success. Surrey BC's Russell Brewing opened a brewery in Hefei, China. Russell's first brewery was so successful that they built a larger brewery in Jiujiang, China, which has since undergone yet another expansion.

Distributors

Working with an importer or distributor in the export market is arguably the most common way to enter a new market. Working with someone who understands the import procedure in the foreign country has connections with all the right buyers and an established sales force greatly reduces your risk.

Of course, your distribution partner will need to make money on the transaction, so this will reduce your margins.

When negotiating with your distribution partner, make sure you understand and agree upon shipping terms.

Also, be sure to come to an agreement on payment terms (including payment currency). Your distributor will obviously want to pay you as late as possible, while you will want to receive payment as soon as possible. A common compromise is to require a deposit be paid prior to shipping, which at least covers your product input costs with the profit paid later.

Of course, there will be accounts receivable risk and foreign exchange risk for the duration of the outstanding receivable. Export Development Canada offers credit risk analysis and receivables insurance (for a fee) while all major banks offer currency-hedging products.

Licensing or contract brewing

As mentioned in Section 4, it is possible to contract brew or have your beer brewed under licence in the foreign market. As with any other market entry strategy, it will be essential to find a partner that you trust, who will produce your beer with the care that you do at home. Moreover, of course, it will be necessary to adjust your recipes for the quality and availability of local ingredients.

When it comes to licensing, breweries that have done so advise that it is best to export your beer using traditional methods (i.e. shipping beer to a distributor) to build your brand in the export market before embarking on the licensing strategy.

Bulk exports

It is possible to export beer in large totes for packaging in the foreign market. This strategy has financial advantages such as:

- more economical shipping

- reduced risk of breakage in transit

- packaging in the export market will comply with labelling and recycling requirements

On the other hand, there is risk of oxygen pick up both in transit and during packaging, particularly since that packaging will be outside your control.

Although there are some European breweries exporting bulk beer to North America and then packaging the beer in bottles, cans and kegs, we are not aware of any Canadian brewery employing this strategy for export markets. We discuss this possibility merely for future consideration.

Opportunities in Asia Pacific

Australia

Market overview

In 2018, Australia's gross domestic product (GDP) was valued at US $1.4 trillion, ranking the country of 25.6 million people as the 13th largest economy in the world and Canada's 16th largest trading partner.

Canadian craft beers have the potential to do well in the Australian market. Australian consumers generally, and craft beer consumers in particular, are happy to experiment with new products – including imported beer. Canadian products have a good reputation in the Australian market and regarded as high quality and safe. As a fellow Commonwealth nation, there is an inherent level of trust between the two countries.

Regulations

Excise duty

Excise duty, or a customs duty equivalent for imported alcohol, is payable on all alcohol products sold in Australia. Excise rates are expressed per litre of alcohol for alcoholic beverages. The volume of alcohol subject to excise duty is calculated by multiplying the actual volume of product by its alcoholic strength. Excise rates for alcohol are indexed twice a year, in line with the consumer price index. Generally, indexation occurs in February and August.

For beer excise duty is payable on the alcohol content above 1.15% ABV in the finished product. Australia is the only Organization for Economic Cooperation and Development (OECD) country applying different excise rates to beer for packaged beer and for draught beer. In addition, there are differing rates based on the alcohol content of the beer, with rates changing at 1.15% ABV, 3.0% ABV, 3.5% ABV and 10% ABV thresholds. Consult the Canadian government Tariff Finder website for specifics.

The bottom line is Australia has the fourth highest excise duty on beer in the industrialised world.

Goods and service tax

The Goods and Services Tax (GST) is imposed at a rate of 10% of the retail price of the beer, inclusive of the excise tax.

As a result, tax (excise and GST) accounts for almost half (42%) of the price of a typical carton of full-strength beer.

Recycling

Despite some considerable efforts to introduce a national container deposit scheme, Australia has State-based schemes. South Australia, New South Wales, Western Australia, Queensland, the Australian Capital Territory and the Northern Territory currently have Container Deposit Schemes, with the other States expected to follow in the coming years (Tasmania is expected to introduce its scheme in 2022; and a Victorian scheme will be introduced in 2023). Work with your importer/distributor to ensure compliance.

Labelling

Food Standards Australia New Zealand (FSANZ) is the Australian Government agency that develops food standards for Australia and New Zealand. The food standards are included in the Food Standards Code. FSANZ includes labeling requirements in the Food Standards Code - this document is a User Guide, which provides an overview for the requirements of the Food Standards Code as they relate to the labelling of alcoholic beverages.

Australia has an Alcohol Beverages Advertising Code (ABAC) administered by a Management Committee, which includes industry, advertising and government representatives, which, in addition to writing the code, administers a pre-vetting service (for a fee) and a complaints handling process. Packaging that falls within any one of the following categories will breach the ABAC standard if it is:

- likely to appeal strongly to minors

- specifically targeted at minors

- particular attractiveness for a minor beyond its general attractiveness for an adult

- using imagery, designs, motifs, animations, or cartoon characters that are likely to appeal strongly to minors, or that create confusion with confectionary or soft drinks

- using brand identification, including logos, on clothing, toys, or other merchandise for use primarily by minors

Competitive pricing model

Consumers are also willing to pay a premium price for craft beer (and therefore it is possible to cover the extra costs of transporting beer to Australia and sell the beer at a profit). Craft beer drinkers are familiar with the example of wine where the Australian market caters to a range of customers from those looking for a bottle under $10 to those willing to pay more than $100 a bottle.

Market entry strategies

While there are a small number of importers who distribute Canadian beer in Australia, Canadian beer is certainly not widely available in Australia. The larger grocery chains expect consistency of supply and many small breweries in Canada have not been able to meet these requirements. Canadian craft breweries have enjoyed some limited success with specialty shops.

Canadian craft beer exporters should identify importers/distributors as potential partners in the Australian market. This is the best means of getting your products into the Australian market and is the approach pursued by most Canadian exporters when they initially enter the Australian market.

Another way of show casing your beer to the Australian market is to attend one or more of the trade shows held in Australia. The best trade show for beer in Australia is Good Beer Week held in May. Its website describes it as "a global festival made up of more than 300 diverse and innovative events across Melbourne and Victoria that attracts seventy-five thousand attendees from across Australia and overseas." There are, of course, other similar events.

The 2019 Australian Craft Beer Survey discusses the importance of social media, beer news and brewery websites and blogs in show casing new and innovative craft beers to Australian consumers. It will be important to support your importer/distributor and trade show efforts with these forms of electronic communications specifically directed at Australian craft beer consumers.

According to the 2019 Australian Craft Beer Survey, with the large, mostly foreign-owned corporate breweries increasingly developing their own craft brands or acquiring successful independent brewers, consumers have started to question the independence of local brewers. Australian Independent Brewers Association has released an "Independence Seal" which is now widely recognized by craft beer drinkers.

There has recently been significant growth in consumers purchasing craft beer online. Thirty percent purchased beer online at least every six months or more often in 2019, compared to 22% in 2018. Craft beer specialty websites account for the majority of purchases.

Logistics

The major seaport in Australia is Melbourne. On the west coast, the Port of Hedland is the largest container port in Australia. Other major ports include Sydney, Brisbane, and Freemantle. Keeping in mind that seasons in the southern hemisphere are opposite those of Canada, temperature-controlled containers are advisable, given the swing in temperature during transit.

Contact

David Ingham

Trade Commissioner

High Commission of Canada

Commonwealth Avenue, Canberra ACT 2600, Australia

Tel: +61 2 6270 4034

Fax: +61 2 6270 4081

email: david.ingham@international.gc.ca

China

Market overview

China is the largest beer market in the world. While overall beer volume is trending down, as consumer purchasing power is rising, the dollar value of the beer market is growing. Young Chinese consumers, in particular, are acquiring a taste for international premium products, but craft beer is still immature, representing less than 0.1% of the overall beer market.

Even as imported beer is growing in China, Canada is lagging. Canada is China's 35th largest import partner for beer. There is plenty of opportunity for Canadian breweries!

Regulations

Registration

In order to export beer to China, your brewery will need to be registered with the General Administration of Quality Supervision, Inspection and Quarantine of the People's Republic of China (AQSIQ). AQSIQ issues many regulations relating to food and wine, which are beyond the scope of this report. Suffice it to say the regulations are extensive, so understand these rules well, or work with a Chinese import partner.

Labelling

The Chinese beer market embraces claims of premium products. Labels should use words like "premium" to promote their high quality. Any certifications, including awards listed on the label, will require proof through documentation (that is, you will have to file copies of your certifications and awards certificates). Other helpful claims include:

- "no additives"

- "no preservatives"

- "seasonal"

- "environmentally friendly packaging"

- "limited edition"

Having said that, certain other labels, such as "organic" are prohibited.

The alcohol content of your beer must be marked with the unit followed by "% vol". Beers must also disclose the original wort concentration, titled with "original wort concentration" and the unit shall be "°P". Country of origin, manufacturing date, type of beer, contents (in metric) and the name and address of the Chinese distributor must all be on the label.

The label must also include the following warnings:

- "Excessive drinking is harmful to health (过量饮酒有害健康)"

- If the beer is packaged in a glass bottle, the label must state, "do not hit to prevent the explosion of the bottle (切勿撞击,防止爆瓶)".

Shelf life must also be disclosed but fermented alcoholic beverages (alcoholic beverages whose alcohol content is greater than 10% ABV) are exempt from this requirement.

Your beer label will need to be registered with and approved by AQSIQ before the beer leaves Canada. Given the complexity of the regulations, and the language and cultural differences, working with a local company in China is very important.

Banned ingredients

A number of ingredients common in Canadian brewing, particularly clarifying agents such as Biofine, are banned in China. There are a number of other restricted ingredients for beer (for example saffron and elderflower), so if you brew beers with unusual ingredients, you should not assume that just because they are acceptable in Canada, they would be acceptable in China. Be sure to work with a local import agent to make sure you do not inadvertently conflict with these bans.

There are a number of food safety standards with which import breweries must comply. These are not a simple matter and Canadian breweries would be well advised to work with a local company to ensure compliance. For example, beers with low pH may not be accepted, so currently popular kettle sour beers may be rejected for import into China.

Product testing

Products are tested before they are released in China and often food products, including beer, require lab testing before they are permitted to leave Canada.

Taxes

Customs duties, value-added and consumption taxes are applicable and assessed at the point of importation. If you are working with an importer, make sure it is clear who is responsible for paying these taxes.

Customs clearance

The documents required for import clearance are:

- commercial invoice

- purchasing agreement

- packing slip

- certificate of authenticity/certificate of free sale

- certificate of origin

Competitive pricing model

The Chinese beer market is price sensitive. Mass market Tsingtao, for example, can be purchased in 24-packs of 330ml cans for RMB218 (approximately $27). Twenty-four bottles of Duvel, by contrast, sells for RMB336 (approximately $67).

Market entry strategies

Although the craft beer market is relatively small in China, it is growing. The market for stout, for example, has grown about 50% per year for the last several years. While the overall beer market favours on-trade, craft beer strongly favours off-trade.

500ml is the most popular package size, followed by 330ml (common for beers from Europe and Australia) and 355ml. As of 2017, the 473ml can was essentially non-existent in China.

Despite an interest in foreign beer, the population of China strongly supports domestic companies. Therefore, a partnership or joint venture with a domestic brewer is a viable strategy. Either way, it is essential to partner with a local agent. There are regional preferences that are best understood by local agents.

It can take a long time to build a trusting relationship with a new business partner. Therefore, if possible, an introduction through a common party is a better way to start. Expect to have several meetings to build a relationship before any actual business is conducted.

When considering a market as large as China, it is important for breweries to make targeted market entry plans. There is severe competition and Canadian brands generally lack brand recognition and limited customer awareness. Canadian breweries entering the China market should be prepared to spend resources on developing a market working in concert with their importer.

The Chinese market generally eschews high-alcohol beers. There is a very strong preference for beers 5% ABV or lower. Cheap domestic beers range between 2% ABV and 3% ABV, so 5% ABV is already perceived as strong beer.

Chinese consumers, especially millennial urbanites in first-tier cities, buy almost everything online. This includes foreign beer due to the convenience of the developed delivery system in tier-one cities. Beer can be sold online through an online Chinese supermarket and high-end beers are generally purchased online. The most used and trusted e-commerce platforms include Tmall and JD.com.

Chinese millennials are active on social media. In China, WeChat and Weibo reign supreme. Indeed, WeChat, which incorporates email, is often the preferred platform for conducting business.

China has a reputation for intellectual property theft. If you intend to protect your intellectual property rights, be aware that the China Trade Mark Office operates on a "first-to-file" basis.

Logistics

With a relatively long coastline, China has 34 major ports and thousands of minor ports. The Port of Shanghai is not only the largest port in China, but also the largest port in the world. It is the gateway to the Yangtze River delta.

With so many ports, is will be a simple matter of working with your freight forwarder to find an efficient route for your beer.

Contacts

Yuan Ping (Sophia)

Trade Commissioner

Embassy of Canada

19 Dongzhimenwai Dajia, Chaoyang

Beijing, PRC 100600

Tel: +86 10 51394151

Fax: +86 10 51394450

email: ping.yuan@international.gc.ca

Japan

Market overview

The Japanese beer market is the fourth largest in the world. As with much of the rest of the world, over the last few years, overall beer sales are down or stagnant. In addition, with much of the rest of the world, craft beer is the exception to this downward trend. Having said that, craft beer remains less than 1% of the total beer market.

Canada has had the highest growth increase in exporting beer to Japan in the past five years with a compound annual growth rate (CAGR) of 88% albeit from a small base. In 2017, Japanese imports of Canadian beer were US $197,622.

Regulations

Tariffs

There is no beer tariff in Japan for beer from Canada. However, beer is taxed at different rates based on malt content. Canadian brewers using all malt should be aware that their products will be taxed at the highest rate.

Labelling

The Japanese government must approve all beer labels. There is a significant amount of information required on the label in Japanese that must be on each individual can or bottle and on any packaging (like a six-pack box). Most importers will require you to affix these labels in Canada, but some importers may be able to change labels in Japan. In either event, Canadian breweries should work closely with their importer to ensure compliance with these requirements.

Recycling

Your cans and bottles are required to carry the Japanese recycling symbol. No further registration of the container itself is required.

Competitive pricing model

Canadian craft beer can be priced at two to three times that of domestic premium beer.

Market entry strategies

It is recommended that companies work closely with a local partner to determine the exact export and retail requirements for the market as local companies have a large presence in the Japanese beer market. Companies interested in pursuing these markets should consider gaining first-hand experience through trade shows and conferences.

Two trends in craft beer are the divergence of alcohol strength. Both high-alcohol beers and non-alcoholic beers are growing in popularity.

Sales of beer have suffered in the last few years due to the increasing popularity of spirits-based RTDs. Local breweries have responded with high-alcohol beers (7% to 8% ABV) which have proven popular.

Conversely, consumers over 40 wishing to enjoy beer on weekdays have gravitated to non-alcoholic beers.

Craft beer is growing dramatically at compound rates over 40%. Wheat/weiss/weizen itself is growing at compound rates over 60%. However, it should be kept in mind that these growth rates are from a small base. In 2007, craft beer represented less than 0.5% of sales. By 2016, it had more than tripled to 1.74% market share.

Japan has significant beer off-trade, particularly in craft beer. However, imported beer has had significant growth on-trade as consumers dining out are more likely to try foreign beer.

Internet retailing of beer is not popular. In 2017, only 2.3% of beer was sold online, having dropped from a high of 3% in 2015.

Logistics

The five largest container ports in Japan are:

- Kobe

- Nagoya

- Osaka

- Tokyo

- Yokohama

We are aware that some Canadian breweries have exported small quantities of beer using airfreight.

Contact

Noboru Shimizu

Trade Commissioner

Embassy of Canada

3-38, Akasaka 7-Chome, Minato-ku

Tokyo 107-8503

Tel: +81 3-5412-6482

Fax: +81 3-5412-6327

email: Noboru.Shimizu@international.gc.ca

South Korea

Market overview

South Korea has a highly educated work force with low unemployment and low public debt, and has enjoyed sustained steady economic growth.

South Korea is the 11th largest market for beer in the world, just ahead of Canada in the 12th spot. Craft beer has seen explosive growth in South Korea since 2014. Millennials, particularly, are looking for greater diversity and new flavours. Prior to this trend, two large domestic brewers dominated the South Korean beer market.

Social drinking after work is a part of professional life in South Korea. "Hoesik" literally means dinner with co-workers, but it often means drinking with them. Company dinners (drinking) after a long workday are very common. Spirits were the drink of choice for hoesik (in 2014, South Korea ranked first in the world for shots of alcohol consumed), but younger people are seeking drinks with lower alcohol.

Currently, the awareness of Canadian craft beer in the South Korean market is very low. While some products were imported in the past, few are currently distributed in the market. Therefore, as a perception of Canadian craft beers has not been established, there is opportunity.

Regulations

By law, only licensed liquor importers are allowed to import alcoholic beverages, including beer.

Tariffs

The South Korean tariff on beer, currently 4.2%, will be eliminated by 2021 (it has been lowered every year since 2015). However, both domestic and imported alcohol are taxed at 72%, based on the import price. Under a new liquor tax that took effect on January 1, 2020, beer receives a discount from this tax. Packaged beer receives a 24% discount while beer distributed in kegs receives a 20% discount.

Labelling

All imported food products are required to carry Korean language labels. There are labelling standards that apply to all food products, including beer. ((South Korea) Ministry of Food and Drug Safety, 2019) Labelling standards can be complicated and breweries should work with an experienced importer to ensure compliance.

Translated sample label from an American craft beer in South Korea

| Product name | New Belgium Fat Tire Belgian White |

|---|---|

| Product type / Beer | Country of Origin / USA |

| Contents and alcohol volume | 335 ml |

| Importer's name and address | Shinsegae L&B |

| Ingredients | Purified water, malt, wheat, oat, yeast. |

| Name of manufacturer | New Belgium Brewing Company |

| Where to return or exchange | Importer |

| Manufacture date | 2018. 7. 20 |

| Shelf life | 2019. 7. 20 |

| Storage condition | Do not expose directly to sunlight. |

| For large-size stores | Not allowed to be sold in restaurants and bars |

Fraudulent or unsanitary foods report Call 1399 Warning: Excessive drinking causes stroke, memory impairment or dementia. Drinking in pregnancy raises the risk of birth of congenital anomaly. The sale to persons under 18 is prohibited | |

While there are some export markets where compliance with labelling requirements can be satisfied with a strip label, for South Korea, it is likely you will have to print a label specifically for the market.

Recycling

Recycling labelling of all beer containers is mandatory. The symbol varies by colour and lettering depending on the container material. Your importer should assist with compliance.

Customs clearance

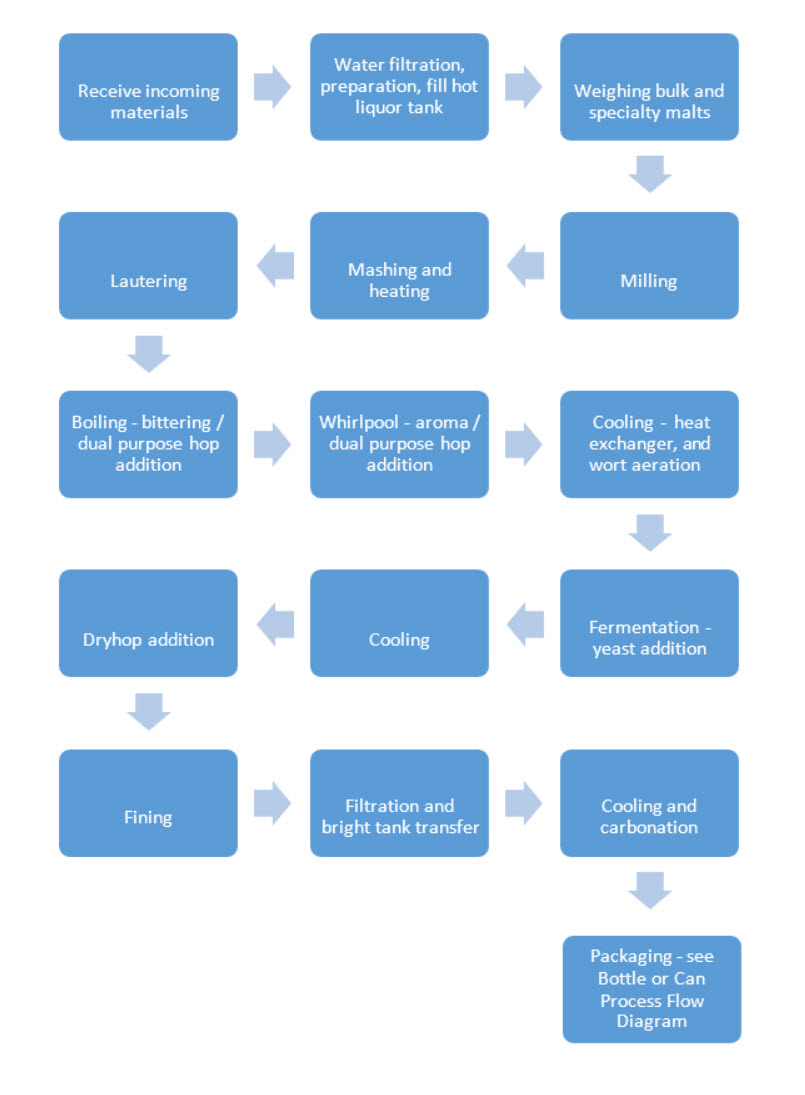

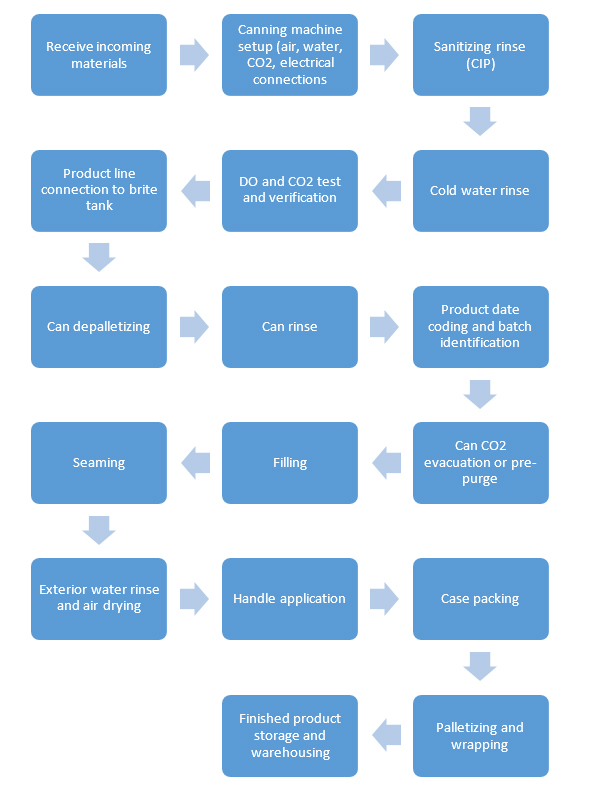

For import declaration for food, a list of all ingredients with component proportion ratio (100%) and process flow diagram will be required.

A bill of lading, commercial invoice and packing list are the required documents for import clearance. In addition, to take advantage of the tariff benefit of Canada-Korea Free Trade Agreement, a certificate of origin signed by the Canadian brewery is required.

Foreign manufacturers should register with the South Korean Ministry of Food and Drug Safety at least seven days before import declaration. Registration is done online at the Ministry's website.

As with other aspects of exporting to South Korea, breweries are advised to work with their South Korean import partners regarding detailed documents and registration.

Competitive pricing model

For imported beer, lower-priced beers or major beer makers are sold at 10,000 won (approximately $11 CAD) for four cans of 500ml at convenience stores and hypermarkets. Some craft beers from large-sized craft breweries are available at the same price for three or four cans. Most craft beers are sold at over 5,000 won (approximately $5.50 CAD) for 355ml or 473ml can or bottle in retail stores, and at over 7,000 or even 8,000 won ($7.50 or $9.00 CAD) per glass (pint) in pubs.

Market entry strategies

One of the best ways for new suppliers to establish a relationship with an importer in South Korea is by attending a trade show. Trade shows are particularly impactful because South Koreans value face-to-face contacts and are not likely to respond to cold calls.

Specialty beer shops are the only place to sell craft beer. Hypermarkets, supermarkets and convenience stores generally only sell domestic beer or large import brands (Asahi, Heineken, etc.).

South Korean consumers are seeking variety in beer and premium and international brands. This is countered by an overall trend to reduce alcohol consumption due to health concerns. Low alcohol craft beers may do well.

500ml cans are the most popular package size, followed by 330ml bottles and cans and 355ml bottles and cans. 473ml cans represent a small percentage of the market, although imported craft beers are available in this format. Bottles are still preferred by consumers for imported beer, but the acceptability of cans is increasing, particularly for craft beer. Younger people are more likely to drink at home.

For the draft market, PubKeg and KeyKeg in 20L size are most common, though 30L are acceptable. Use of steel kegs and kegs over 30L is discouraged. Shipping rates to South Korea are favourable while shipping rates from South Korea are not, so the cost of retrieving empty steel kegs is prohibitive.

The South Korean beer market embraces claims of premium products. Labels should use words like "premium" to promote their high quality. Other claims such as "environmentally friendly packaging," "limited edition," "seasonal," "no additives" and "no preservatives" are helpful.

Logistics

The main port of entry for South Korea is Busan Port. Air freight is rarely used.

Contact

Ok-Jin Cho

Trade Commissioner

Embassy of Canada

21, Jeongdong-gil (Jeong-dong), Jung-gu, Seoul 100-120 Republic of Korea

Tel: +82 2 3783-6091

Fax: +82 2 3783-6147

email: ok-jin.cho@international.gc.ca

Opportunities in Europe

Belgium

Market overview

Belgian beer culture is globally recognized. In fact, UNESCO recognized this culture in 2016 when it was added to the "Intangible Cultural Heritage of Humanity" list. Not surprisingly, this beer culture is a source of great pride.

As of 2019 there are 340 breweries serving this population of 11.5 million people. However, most of these breweries brew what is globally recognized as Belgian beer, with a very significant portion brewed for export. Because of this, and because a love of variety from small breweries, there is room in the market for imported Canadian craft beer. Overall, Belgium imported over 2.5 million Hl of beer in 2018.

Regulations

Deposits

Deposits are not required for cans and are optional for refillable bottles. However, there is a tax on beverage containers that are not refillable. Despite being the only EU country not requiring deposits, Belgium boasts some of the highest recycling rates in the world, through blue bag collection on the street.

A pilot project is underway in Wallonia. This program aims to further improve recycling rates by rewarding collection of littered cans, but again, there are no deposit requirements.

Labelling

Beer containing over 1.2% ABV is exempt from EU requirements to list ingredients and nutritional information. However, as of March 12, 2018, the Brewers of Europe created a self-regulatory framework for the voluntary listing of ingredients. Canadian breweries are not required to comply, but there may be consumer expectations. Eighty-five per cent of beers sold in Europe have ingredients labelling.

If you choose to disclose nutritional information, the disclosure should be based on either per 100 millilitres or per portion. Sixty per cent of beers sold in Europe have caloric labelling.

Competitive pricing model

Very good, locally brewed beer can be purchased in Belgium for between €2 and €4 although more premium beers such as Trappist beers and lambic command much higher prices.

Imported beers are priced at only a slight (if any) premium over domestic beers.

Market entry strategies

As with much of the rest of the world, beer consumption is down in Belgium. Beer consumption down 19% from 2009 to 2019; down 31% from 1999 to 2019. Having said that, as with much of the rest of the world, there is a trend away from lagers to more specialty and craft beers.

Another reason for the decline in beer consumption has been the trend toward adopting healthier lifestyles. Coincident with this, the non-alcoholic and low-alcoholic beer segments are growing.

Beer consumption has been trending toward more off-trade. While as much as two-thirds of beer sales have historically been on-trade, that proportion is now slightly less than half.

Sustainability is an important trend all over Europe. Over 70% of beer in Belgium is supplied in returnable and reusable packaging (bottles and crates). While that is obviously not practical for imported beers, any environmental certifications you have should be promoted. In addition, Canada's clean environment should be promoted in your branding.

Logistics