Free Trade Zones in China

Free trade zones (FTZs) are types of special economic zones (SEZs) where goods may be imported, handled, manufactured and exported without direct intervention from customs.

Each FTZ in China has an industrial and economic focus, with different incentives to fulfil its objectives. Incentives and regulations in FTZs align with the Chinese government’s ongoing policy priorities. According to the Chinese Ministry of Commerce, in 2021, China's 21 FTZs contributed 17.3% of China’s total foreign trade (Rmb 6.8 tln) and 18.5% of China’s foreign investment inflows (Rmb 213 bln).

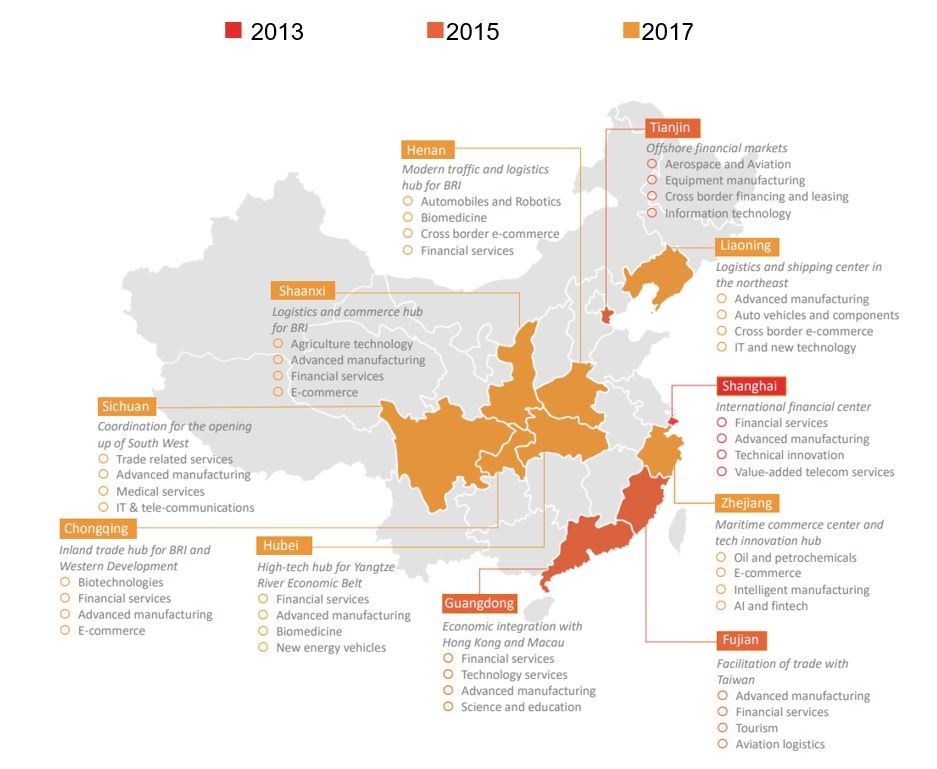

Text version

2013: Shanghai

2015: Tianjin, Fujian, Guangdong

2017: Liaoning, Shaanxi, Henan, Hubei, Chongqing, Sichuan, Zhejiang

2018: Hainan

2019: Heilongjiang, Hebei, Shandong, Jiangsu, Yunnan, Guangxi

2020: Beijing, Anhui, Hunan

Benefits of China’s FTZs

Favorable administrative measures

- Reduced corporate income tax (CIT) (varies by FTZ)

- Duty-free imports and exports

- Bonded warehouse capacity

- Streamlined port and customs operations

- Simplified company registration

- Faster value added tax refund

Optimized business environment

- Targeted policy liberalisation in specific industries

- Purpose-built clustered industrial zones

- Reduced foreign exchange controls

- Additional liberalisations per Foreign Investment Law

Strong human capital

- Subsidies and tax benefits for recruitment of highly skilled workers

- Partnerships with universities to nurture young talents locally

Evolution of China’s FTZs and focused industries

China established its first free zone at Shanghai in 2013 as a testing ground for new regulations. In 2015, three costal provinces announced to strengthening regional economic integration. Two years later, the government set seven more FTZs to support western China and the Belt and Road Initiative (BRI).

Text version

2013 Shanghai

International financial center

- Financial services

- Advanced manufacturing

- Technical innovation

- Value-added telecom services

2015 Guangdong

Economic integration with Hong Kong and Macau

- Financial services

- Technology services

- Advanced manufacturing

- Science and education

2015 Tianjin

Offshore financial markets

- Aerospace and aviation

- Equipment manufacturing

- Cross border financing and leasing

- Information technology (IT)

2015 Fujian

Facilitation of trade with Taiwan

- Advanced manufacturing

- Financial services

- Tourism

- Aviation logistics

2017 Chongqing

Inland trade hub for BRI and Western Development

- Biotechnologies

- Financial services

- Advanced manufacturing

- E-commerce

2017 Sichuan

Coordination for the opening up of South West

- Trade related services

- Advanced manufacturing

- Medical services

- IT and tele-communications

2017 Shaanxi

Logistics and commerce hub for BRI

- Agriculture technology

- Advanced manufacturing

- Financial services

- E-commerce

2017 Henan

Modern traffic and logistics hub for BRI

- Automobiles and robotics

- Biomedicine

- Cross border e-commerce

- Financial services

2017 Zhejiang

Maritime commerce center and tech innovation hub

- Oil and petrochemicals

- E-commerce

- Intelligent manufacturing

- AI and fintech

2017 Hubei

High-tech hub for Yangtze River Economic Belt

- Financial services

- Advanced manufacturing

- Biomedicine

- New energy vehicles

2017 Liaoning

Logistics and shipping center in the northeast

- Advanced manufacturing

- Auto vehicles and components

- Cross border e-commerce

- IT and new technology

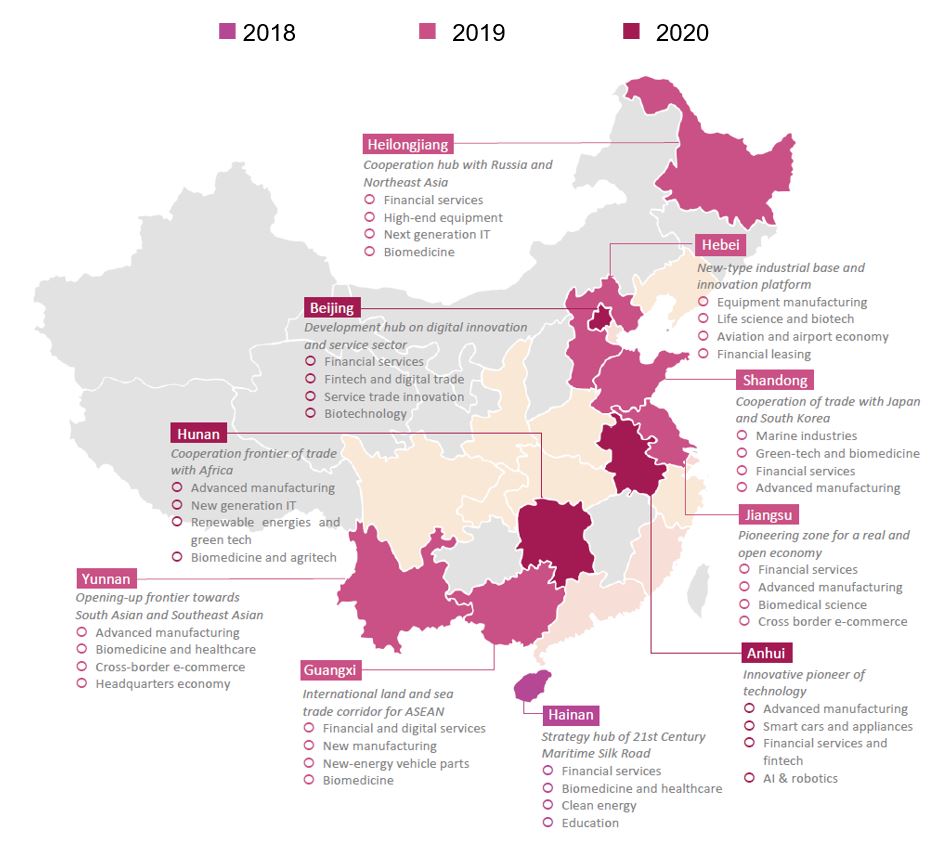

In 2018, China put aside its 120 km2 limitation as for all other FTZs to make the entire Hainan province (35400 km2) a free trade port. Then, in 2019, six new zones were established with the focus on specific policy areas or to facilitate cooperation with certain countries or regions. In 2020, three more inland FTZs followed, in line with Beijing’s recent “strategic emerging industries” plan.

Text version

2018 Hainan

Strategy hub of 21st Century Maritime Silk Road

- Financial services

- Biomedicine and healthcare

- Clean energy

- Education

2019 Jiangsu

Pioneering zone for a real and open economy

- Financial services

- Advanced manufacturing

- Biomedical science

- Cross border e-commerce

2019 Shandong

Cooperation of trade with Japan and South Korea

- Marine industries

- Green-tech and biomedicine

- Financial services

- Advanced manufacturing

2019 Hebei

New-type industrial base and innovation platform

- Equipment manufacturing

- Life science and biotech

- Aviation and airport economy

- Financial leasing

2019 Heilongjiang

Cooperation hub with Russia and Northeast Asia

- Financial services

- High-end equipment

- Next generation IT

- Biomedicine

2019 Guangxi

International land and sea trade corridor for ASEAN

- Financial and digital services

- New manufacturing

- New-energy vehicle parts

- Biomedicine

2019 Yunnan

Opening-up frontier towards South Asian and Southeast Asian

- Advanced manufacturing

- Biomedicine and healthcare

- Cross-border e-commerce

- Headquarters economy

2020 Beijing

Development hub on digital innovation and service sector

- Financial services

- Fintech and digital trade

- Service trade innovation

- Biotechnology

2020 Anhui

Innovative pioneer of technology

- Advanced manufacturing

- Smart cars and appliances

- Financial services and fintech

- AI & robotics

2020 Hunan

Cooperation frontier of trade with Africa

- Advanced manufacturing

- New generation IT

- Renewable energies and green tech

- Biomedicine and agritech

Opportunities

China uses FTZs to pilot new policies and regulations, thus permitting companies to experience more liberalised environment, with potentially lighter regulatory touch. Many international companies found FTZs an attractive option to set up China operations, depending on their industry. While FTZs in Shanghai and other prime Chinese cities have seen initial success, FTZ in Tier 2 and Tier 3 cities have distinct advantages with large pools of young skilled labour, lower costs and access to large regional markets beyond China’s coastal areas that are often overlooked. Many of the FTZs, such as Chongqing, Sichuan, Shaanxi and Henan focus on areas that are Canada’s strengths.

Considerations

Notwithstanding a potentially more liberal regulatory environment in the FTZs, all usual consideration with respect to market entry in China apply. To retain the established association between Canadian brands and qualities, exporters should ensure close attention to branding, customer service, quality control and Corporate Social Responsibility.

Exporters and investors also need to consider that regulations and actual incentives differ by area, and each FTZ may have its own additional requirements. Most importantly, the implementation of national regulations in different parts of China may not be uniform. Therefore, companies need to understand thoroughly the requirements of local regulators. Companies should consult the latest FTZ foreign investment negative list and, if establishing business in China, ensure compliance with the latest Chinese cybersecurity, export controls and other regulations.

Get Help from the Trade Commissioner Service

Located in over 160 cities worldwide, we provide key business insight and access to an unbeatable network of international contacts. We gather market intelligence, uncover commercial opportunities and help reduce the costs and risks of doing business abroad.

- Doing business in China

- Canadian small and medium enterprise gateway to China

- Contact the Canadian Trade Commissioner Service in China.

Disclaimer:

The Canadian Trade Commissioner Service in China recommends that readers seek professional advice regarding their particular circumstances. This publication should not be relied on as a substitute for such professional advice. The Government of Canada does not guarantee the accuracy of any of the information contained on this page. Readers should independently verify the accuracy and reliability of the information.

Content on this page is provided in part by Dezan Shira & Associates a pan-Asia, multi-disciplinary professional services firm, providing legal, tax, and operational advisory to international corporate investors.

- Date modified: