Establishing a wholly foreign-owned enterprise in China

A “wholly foreign-owned enterprise” is a limited-liability company, which is wholly owned by one or more foreign investors. Unlike a representative office, these enterprises can make profits and issue local invoices in renminbi (RMB), China’s official currency, to suppliers. The liabilities of shareholders to a wholly foreign-owned enterprise (WFOE) are limited by the assets they bring to the business. They can also employ local staff directly.

There are three distinct WFOE set-ups:

- service (or consulting)

- trading (or foreign-invested commercial enterprise)

- manufacturing

All three structures have the same legal identity, but they differ significantly in terms of:

- set-up procedures

- costs

- range of commercial activities in which they can engage

Trading and manufacturing WFOEs need to derive most of their revenue from their namesake business but can also provide associated services. Service WFOEs are additionally allowed to conduct training activities related to their services.

WFOE advantages

The advantages of a WFOE company are that it has:

- greater freedom in business activities than a representative office

- 100% ownership and management control

- a suitable investment mode for having a long-term presence in China

- the ability to provide a wide variety of services

- the ability to hire employees directly

- the capability of converting RMB profits to U.S. dollars for remittance to its parent company outside of China

- protection of intellectual property

Establishment procedures

The establishment process differs based on the chosen investment structure and business scope. Manufacturing WFOEs need to complete an environmental evaluation report. Trading WFOEs must undergo customs and commodity inspection registration.

Text version - Set-up procedures in China for a WFOE

Pre-licensing (2 to 3 months):

- Basic information collection from client (depends on client)

- Name pre-approval (5 to 7 working days)

- Certificates on lawful use of office premises (depends on clients/landlord)

- Incorporation documents prepared by client (around 1 month)

- Certificate of Approval from the MOFCOM (1-2 weeks) or record-filing (3-7 working days)

- SAMR issues business license combining (7-10 working days):

- the old business license

- the organization code certificate

- the tax registration certificate

- the social security registration certificate

- the statistics registration certificate

Company now legally exists

Post-licensing (2 to 3 months or more):

- Carve company chop, financial chop, invoice (“fapiao”) chop and legal representative chop (1 to 2 working days)

- Foreign exchange registration certificate (around 2 weeks)

- Foreign capital account (5 to 7 working days)

- Capital injection (in accordance with articles of association)

- Capital verification assistance (2 weeks)

- RMB basic account (2 weeks)

- MOFCOM foreign trade dealer and operator filing (around 5 working days)

- Customs registration (around 2 weeks)

- Commodity inspection registration (1 working day)

- E-port registration (around 2 weeks)

- SAFE import-export enterprise name filing (2 to 3 working days)

- General value-added tax (VAT) taxpayer application (around 30 working days)

- General VAT taxpayer invoice quota (around 30 working days)

The following steps offer a guideline of the establishment process.

Name approval

According to company naming rules, a qualified company name should contain at least the following elements:

- Administrative region name of incorporation

- Brand name

- Industry or business

- Company Limited

Office/facility space lease

The applicant registering a WFOE (if the intended office premises are owned by the same individual or company applying for registration) needs to:

- show a certificate of premises ownership (CPO) issued by the real-estate authority

- submit a copy to the State Administration for Market Regulation (SAMR)

SAMR does not accept “residential” CPOs for registration.

If the office premises are leased, the applicant needs to provide the:

- original lease agreement (with a minimum one-year lease term)

- copy of the CPO

The landlord should be an SAMR-registered business, and applicants may require a copy of the landlord company’s business license, including the company’s official chop (a seal or stamp).

Both parties to the lease agreement should complete the registration process and record-filing procedures with the local real-estate authority within 30 days following the agreement’s conclusion. Once the lease’s legitimacy is confirmed, the authority will issue a housing lease certificate, which basically allows the property to be used for business or manufacturing operations.

If a CPO cannot be produced for SAMR registration, you will need to obtain a certificate to prove you are the legitimate owner of the property. Certificates are issued by either the:

- local real-estate administration authority

- sub-district office

- neighbourhood committee

- administrative institution of a development zone

If the company needs to build a facility, it needs to apply for a construction permit from the local land resources and urban planning committee. Once it is constructed, several inspections are required before the company is provided with a CPO from the local real-estate authority, such as:

- an environmental check

- a fire inspection

- a quality review

Environmental impact assessment (for manufacturing WFOE)

After obtaining proper premises, the company is obliged to submit an environmental impact assessment report to the local environmental protection bureau for approval. This is intended to control the impact that a manufacturing company has on China’s environment.

Five-in-one Business License

The deadline for converting to five-in-one certification was December 31, 2017. Beyond that date, all five certificates held by the company are considered invalid and cancelled.

Businesses need to be aware of regional disparities as local regulations may differ. For example, in Liaoning and Jiangsu province, local authorities are piloting a six-in-one business license in several counties, which includes the company seal carving approval certificate. Other local-level regions are also considering different variations of a multiple certifications business license.

To apply for a business license from SAMR the Company needs to submit the following documents:

- The Company’s business license

- Copy of the Legal Representative’s passport

- Copy of the Directors’ passports and CVs

- Draft articles of association

- Environmental Protection Valuation Report (if applicable)

- Intended name of the company, business scope, and registered capital and business term

- Lease contract for the premises or CPO

Open foreign exchange and RMB bank account

Approval to open this account can be obtained from SAFE.

General VAT taxpayer related procedures

Taxpayers in China are split into two categories when it comes VAT:

- general taxpayers

- small-scale taxpayers

When an entity is registered, it will by default be a small-scale taxpayer and may choose to become general taxpayer.

Taxpayers with annual taxable sales exceeding the annual sales ceiling set for small-scale taxpayers must apply for general taxpayer status. The annual sales ceiling for small-scale taxpayers is RMB 5 million.

To obtain general taxpayer status, taxpayers are required to go through a registration process. VAT general taxpayer registration cannot occur until the end of the corporate establishment process. The general VAT taxpayer status will be effective from the same day the registration is completed.

Key positions

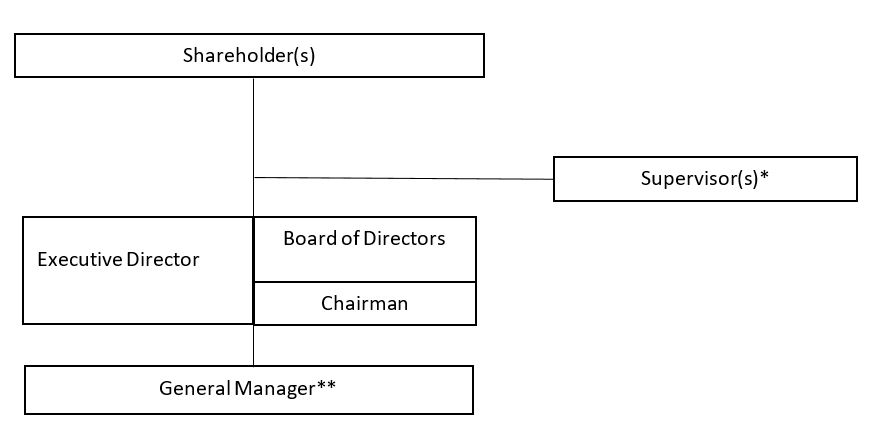

* A supervisor or member of the board of supervisors cannot be a director or among senior management personnel. Larger companies require a board of supervisors composed of representatives for both shareholders and staff.

** The general manager can also be a director or executive director. For JVs, in addition to the general manager, several deputy general managers can also be appointed, collectively referred to as the “management office.”

Text version

Key positions

Shareholder(s)

Supervisor(s)*

Executive Director, Board of Directors, Chairman

General Manager**

Changes under Foreign Investment Law

| Item | Under WFOE Law | Under new FIL |

|---|---|---|

| Organization form | Limited liability company under the WFOE Law, unless otherwise approved by authority in charge | No limitation, could be limited liability company or joint-stock company under the Company Law |

| Statutory fund Reserve |

|

|

| Liquidation group | The liquidation committee shall:

|

|

Disclaimer:

The Canadian Trade Commissioner Service in China recommends that readers seek professional advice regarding their particular circumstances. This publication should not be relied on as a substitute for such professional advice. The Government of Canada does not guarantee the accuracy of any of the information contained on this page. Readers should independently verify the accuracy and reliability of the information.

Content on this page is provided in part by Dezan Shira & Associates a pan-Asia, multi-disciplinary professional services firm, providing legal, tax, and operational advisory to international corporate investors.

- Date modified: